|

UNITED STATES |

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

WASHINGTON, D.C. 20549 |

|

|

SCHEDULE 14A |

|

|

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

|

|

Filed by the Registrant ☒ |

|

|

Filed by a Party other than the Registrant ☐ |

|

|

Check the appropriate box: |

|

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

|

NSTS Bancorp, Inc. |

|

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

Payment of Filing Fee (Check the appropriate box): |

|

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NSTS Bancorp, Inc.

700 S. Lewis Ave.

Waukegan, Illinois 60085

(847) 336-4430

April 15, 2022

Dear Fellow Stockholder:

The 2022 Annual Meeting of Stockholders of NSTS Bancorp, Inc. will be held at the office of North Shore Trust and Savings at 700 S. Lewis Ave., Waukegan, Illinois on Wednesday, May 25, 2022, at 10:00 a.m., Central Time.

The enclosed Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the annual meeting. Also enclosed is our Annual Report on Form 10-K for the year ended December 31, 2021, which contains information concerning our business and 2021 financial performance. Our directors and officers, as well as a representative of our independent registered public accounting firm, are expected to be present at the annual meeting to respond to any questions that stockholders may have.

The business to be conducted at the annual meeting consists of the election of directors and the ratification of the appointment of Plante & Moran PLLC as our independent registered public accounting firm for the year ending December 31, 2022. The Board of Directors has determined that the matters to be considered at the annual meeting are in the best interest of NSTS Bancorp, Inc. and its stockholders, and the Board of Directors unanimously recommends a vote “FOR” each matter to be considered.

On behalf of the Board of Directors, we urge you to sign, date and return the enclosed proxy card, or vote your shares online, as soon as possible to ensure that your shares are represented and voted at the meeting. This will not prevent you from attending the meeting and voting in person, but will assure that your vote is counted if you are unable to attend the annual meeting.

The Proxy Statement and the 2021 Annual Report on Form 10-K are also available at https://ir.northshoretrust.com/sec-filings/all-sec-filings.

|

|

Sincerely, |

|

|

|

|

|

|

|

|

|

|

|

/s/ Stephen G. Lear |

|

|

|

Stephen G. Lear |

|

|

|

Chief Executive Officer |

|

NSTS Bancorp, Inc.

700 S. Lewis Ave.

Waukegan, Illinois 60085

(847) 336-4430

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 25, 2022

Notice is hereby given that the 2022 Annual Meeting of Stockholders of NSTS Bancorp, Inc. will be held at the office of North Shore Trust and Savings located at 700 S. Lewis Ave., Waukegan, Illinois on Wednesday, May 25, 2022 at 10:00 a.m., Central Time.

A proxy card and the Proxy Statement for the annual meeting are enclosed. The annual meeting is for the purpose of considering and acting upon:

1. the election of two directors identified in the proxy statement for a term expiring at the 2025 Annual Meeting; and

2. the ratification of the appointment of Plante & Moran PLLC as independent registered public accounting firm for the year ending December 31, 2022.

Stockholders also will transact any other business that may properly come before the annual meeting, or any adjournments thereof, as determined by the Board of Directors. The Board of Directors currently is not aware of any other business to come before the annual meeting.

Any action may be taken on the foregoing proposals at the annual meeting on the date specified above, or on the date or dates to which the annual meeting may be adjourned or postponed. Stockholders of record at the close of business on March 31, 2022 are the stockholders entitled to vote at the annual meeting, and any adjournments or postponements thereof.

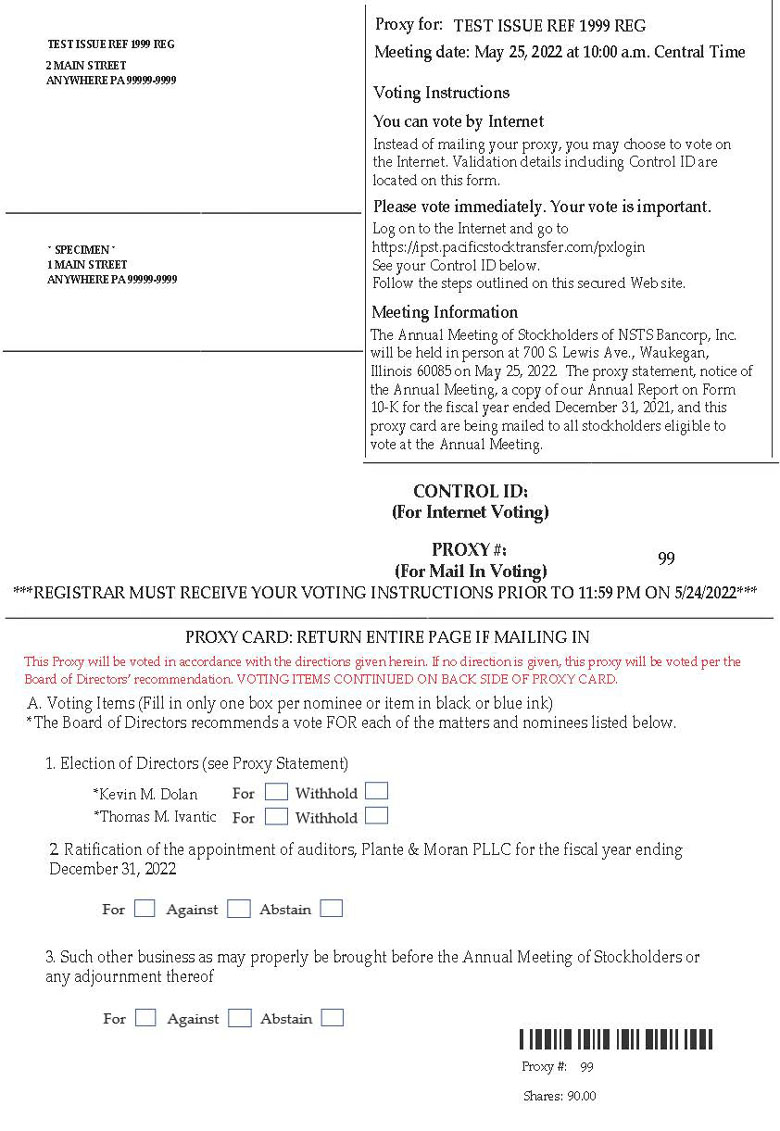

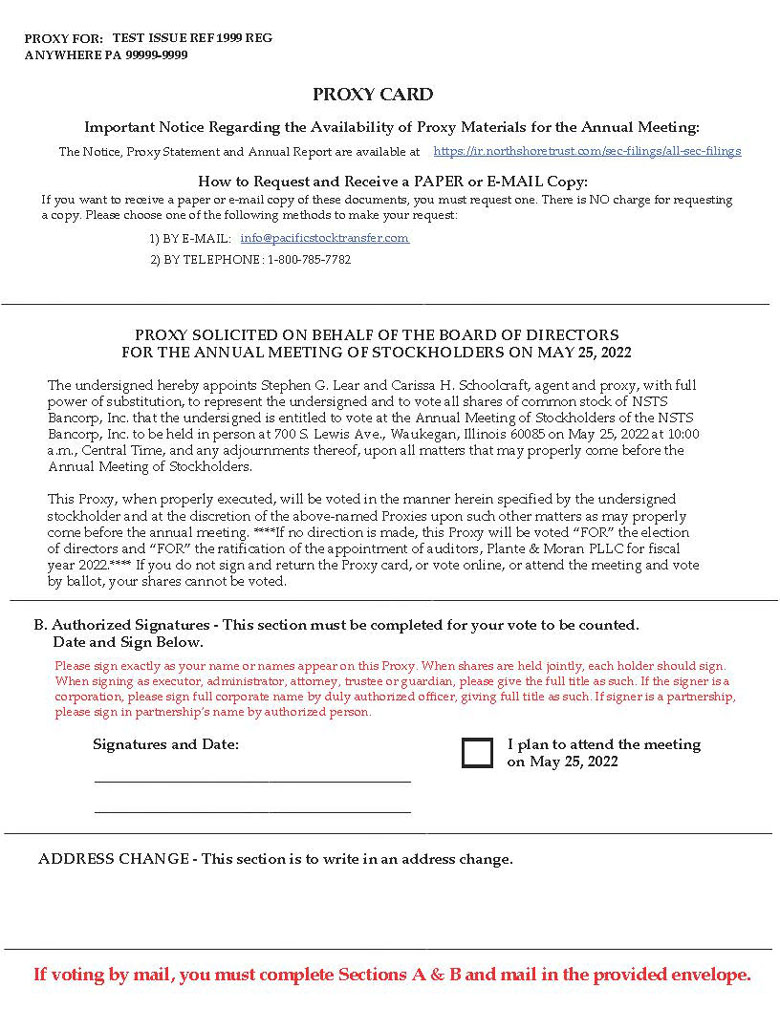

Please submit a proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. You may submit your proxy (1) through the Internet or (2) by completing, signing, dating and returning the enclosed proxy card in the enclosed postage-paid envelope by mail. For specific instructions, please refer to the accompanying proxy card. Any stockholder present at the annual meeting may revoke his or her proxy and vote personally on each matter brought before the annual meeting. However, if you are a stockholder whose shares are not registered in your own name, you will need additional documentation from your record holder in order to vote in person at the annual meeting. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

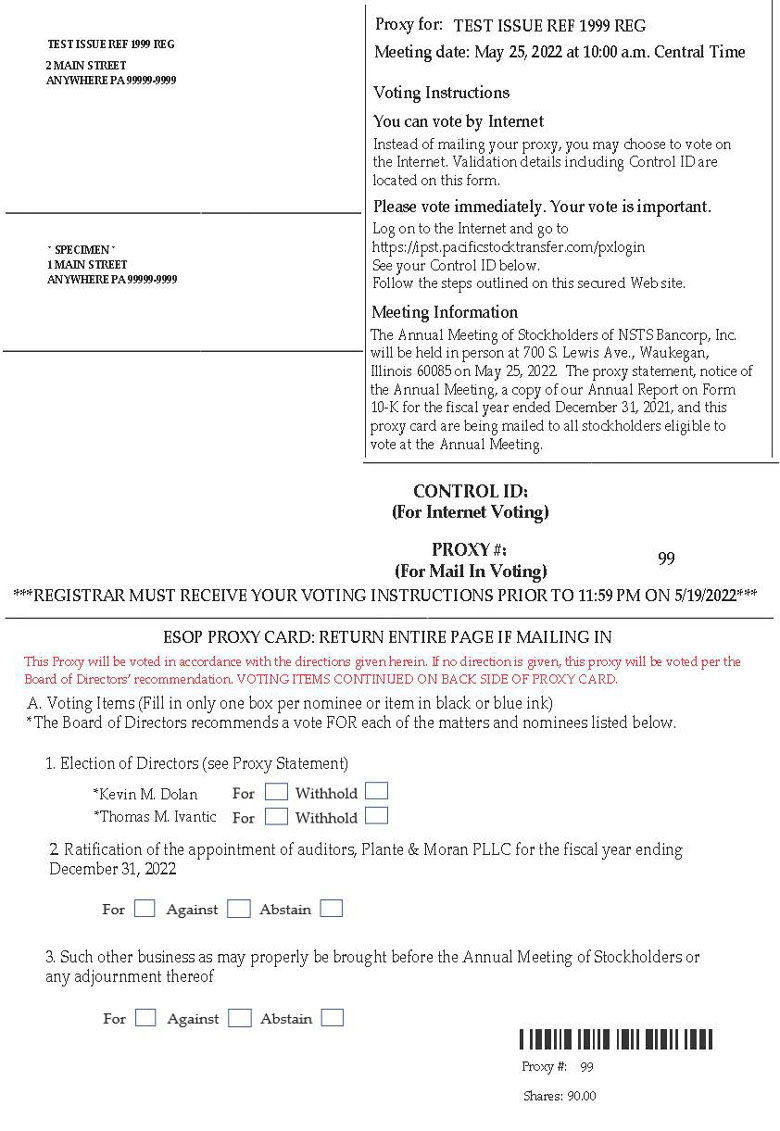

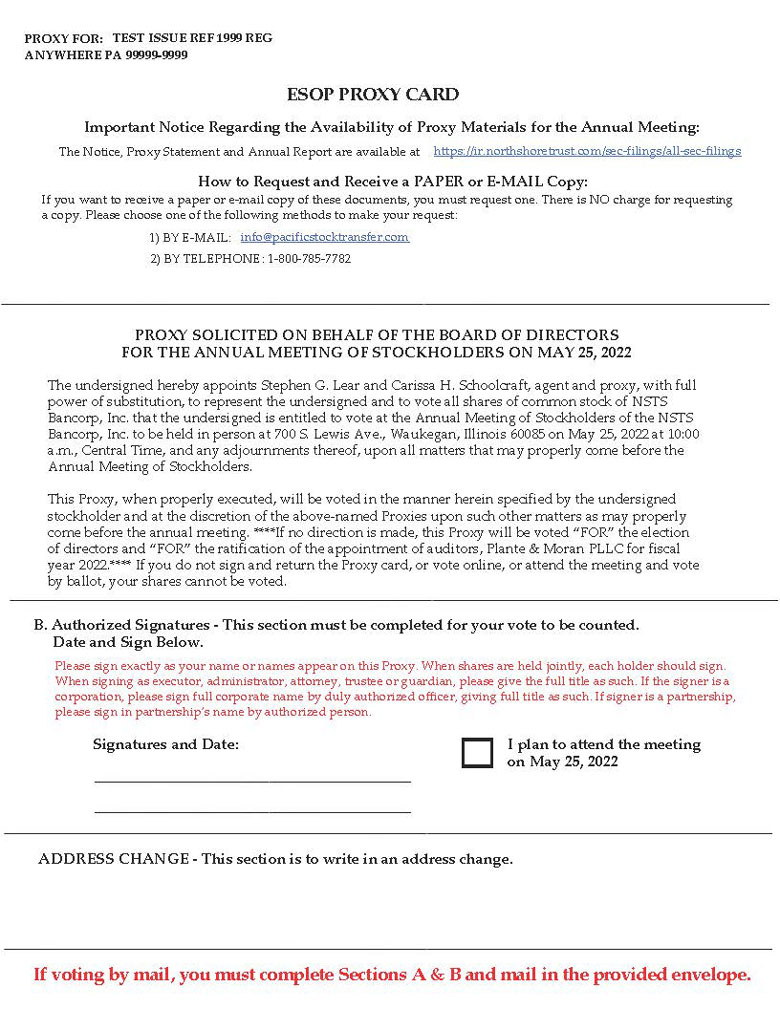

We also are soliciting voting instructions from participants in the North Shore Trust and Savings Employee Stock Ownership Plan (“ESOP”) who may direct the ESOP trustee to vote shares on their behalf under the ESOP. We ask each plan participant to sign, date and return the accompanying voting instruction card or provide voting instructions through the Internet as described on the voting instruction card.

|

|

By Order of the Board of Directors |

|

|

|

|

|

|

|

/s/ Christine E. Stickler |

|

|

|

Christine E. Stickler |

|

|

|

Corporate Secretary |

|

Waukegan, Illinois

April 15, 2022

Important: The prompt return of proxies will save the expense of further requests for proxies. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed within the United States.

PROXY STATEMENT

OF

NSTS BANCORP, INC.

700 S. LEWIS AVENUE

WAUKEGAN, ILLINOIS

ANNUAL MEETING OF STOCKHOLDERS

May 25, 2022

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of NSTS Bancorp, Inc. (the “Company”) to be used at the Company’s Annual Meeting of Stockholders to be held at the Main Office of North Shore Trust and Savings (the “Bank”), 700 S. Lewis Avenue, Waukegan, Illinois, on May 25, 2022, at 10:00 a.m., Central Time (the “Annual Meeting”). The accompanying Notice of Annual Meeting and this Proxy Statement are being first mailed to stockholders on or about April 15, 2022.

At the Annual Meeting, stockholders will consider and vote upon the election of two directors of the Company, each to serve a three-year term, and the ratification of the appointment of Plante & Moran PLLC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

VOTING AND PROXY PROCEDURES

Who Can Vote at the Annual Meeting

You are only entitled to vote at the Annual Meeting if our records show that you held shares of our common stock, par value $0.01 per share (the “Common Stock”), as of the close of business on March 31, 2022 (the “Record Date”). If you wish to attend and vote your shares at the Annual Meeting and your shares are held by a broker or other intermediary, you can only vote your shares at the Annual Meeting if you have a properly executed proxy from the record holder of your shares (or their designee). As of the Record Date, a total of 5,397,959 shares of Common Stock were outstanding. Except as otherwise noted below, each share of Common Stock has one vote on each matter presented. The presence, in person or by proxy, of at least a majority of the total number of shares of Common Stock outstanding and entitled to vote will be necessary to constitute a quorum at the Annual Meeting.

Voting by Proxy

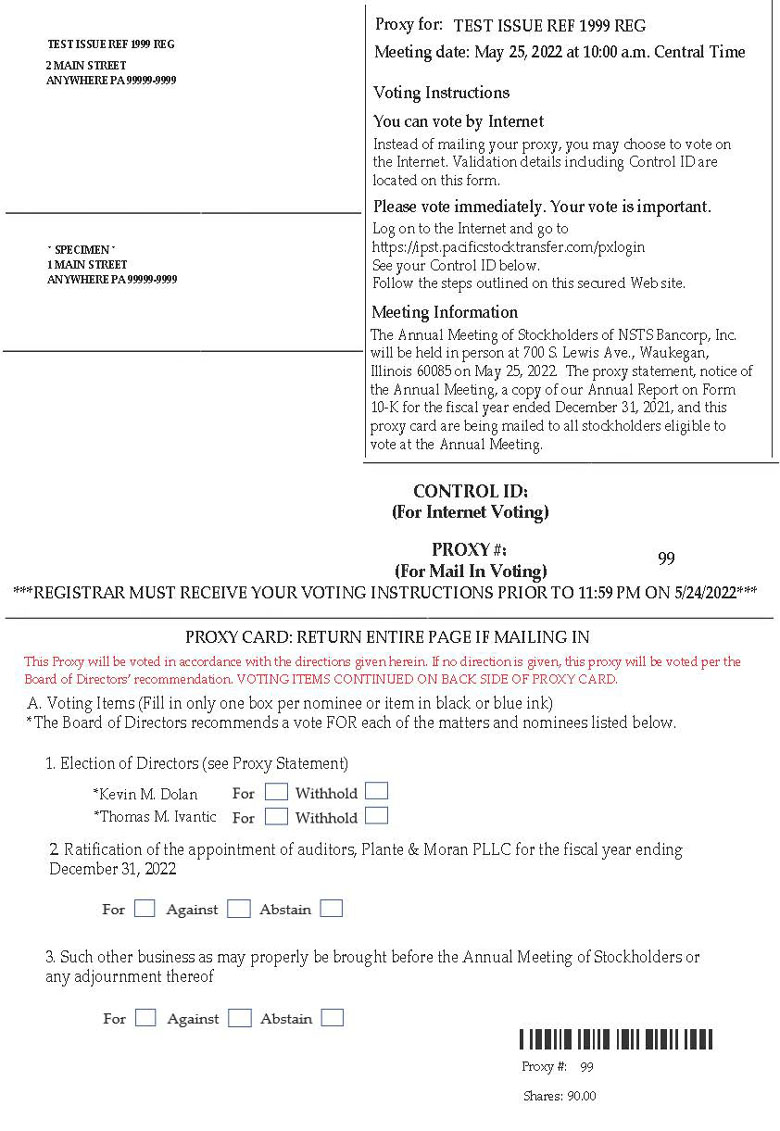

The Board of Directors is sending you this Proxy Statement for the purpose of requesting that you allow your shares of Common Stock to be represented at the Annual Meeting by the persons named in the enclosed proxy card. As shown on your proxy card, you may also vote your shares by Internet voting. All shares of Common Stock represented at the Annual Meeting by properly submitted and dated proxies will be voted according to the instructions indicated on the proxy. If you execute a proxy (by any permitted method) without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors.

The Board of Directors recommends a vote “FOR” its nominees for directors, and “FOR” the ratification of the appointment of Plante & Moran PLLC as our independent registered public accounting firm.

The Company does not know of any other matters to be presented at the Annual Meeting. If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the persons named in the proxy will vote your shares as determined by a majority of the Board of Directors. If the Annual Meeting is postponed or adjourned, your shares of Common Stock may be voted by the persons named in the proxy card on the new Annual Meeting date as well, unless you have revoked your proxy. You may revoke your proxy at any time before the vote is taken at the Annual Meeting. To revoke your proxy you must advise the Company’s Corporate Secretary in writing before your Common Stock has been voted at the Annual Meeting, deliver a later-dated proxy (executed in writing or via the Internet), or attend the Annual Meeting and vote your shares in person. Attendance at the Annual Meeting will not in itself revoke your proxy.

If you hold your Common Stock in “street name,” you will receive instructions from your broker, bank or other nominee that you must follow in order to have your shares voted. Your broker, bank or other nominee may allow you to deliver your voting instructions via the Internet.

Please see the instruction form provided by your broker, bank or other nominee that accompanies this Proxy Statement. In order to vote in person at the Annual Meeting, you will need special documentation from your broker, bank or other nominee. Please note that pursuant to the rules that guide how brokers vote your stock, your brokerage firm or other nominee may not vote your shares with respect to the election of directors (Proposal I) without specific instructions from you as to how to vote because it is not considered “routine” matter under the applicable rules. Proposal II is a matter we believe will be considered “routine”; even if the broker or other nominee does not receive instructions from you, the broker or other nominee is entitled to vote your shares in connection with Proposal II.

Participants in the North Shore Trust and Savings Employee Stock Ownership Plan

If you are a participant in the North Shore Trust and Savings Employee Stock Ownership Plan (“ESOP”), you will receive a voting instruction card that reflects all the shares that you may direct the ESOP trustee to vote on your behalf under the ESOP. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but you may direct the trustee how to vote the shares of Common Stock allocated to your ESOP account. The ESOP trustee will vote all unallocated shares of Common Stock held by the ESOP, all allocated shares for which no voting instructions are received and all allocated shares for which participants have voted “abstain” in the same proportion as shares for which it has received timely voting instructions. Under the ESOP, since no shares have been allocated to the participants at the time of the stockholder vote, you will be deemed to have one share for purposes of giving such voting instructions.

Quorum and Vote Required

Business cannot be transacted at the Annual Meeting unless a quorum is present. The presence in person or by proxy of holders of a majority of the total number of outstanding shares of Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining that a quorum is present. A “broker non-vote” occurs when a broker, bank or other nominee holding shares for a beneficial owner does not have discretionary voting power with respect to the agenda item and has not received voting instructions from the beneficial owner. In the event there are not sufficient shares represented in person or by proxy for a quorum, or to approve or ratify any matter being presented at the time of the Annual Meeting, the Annual Meeting will be adjourned in order to permit further solicitation of proxies.

In voting on the election of directors (Proposal I), you may (i) vote for all the nominees; (ii) vote to withhold for all the nominees; or (iii) vote for all nominees except one or more of the nominees. There is no cumulative voting in the election of directors. Directors are elected by a plurality of the votes cast at the Annual Meeting. This means that the nominees who receive the highest number of votes cast are elected, up to the maximum number of directors to be elected at the annual meeting. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In voting to ratify the appointment of Plante & Moran PLLC as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal II) you may (i) vote for the ratification; (ii) vote against the ratification; or (iii) abstain from voting on such ratification. To be approved, this proposal requires the affirmative vote of a majority of the votes cast at the Annual Meeting. Broker non-votes and abstentions will not be counted as votes cast and will have no effect on the voting on these proposals.

Under rules applicable to broker-dealers, the proposal to ratify the independent registered public accounting firm is considered a “discretionary” item upon which brokerage firms may vote in their discretion on behalf of their clients if such clients have not furnished voting instructions. The election of directors is considered “non-discretionary” for which brokerage firms may not vote in their discretion on behalf of clients who do not furnish voting instructions and, thus, there may be broker non-votes at the Annual Meeting. You should use the proxy card provided by the institution that holds your shares to instruct your broker to vote your shares, or submit your vote online by following the instructions on the proxy card, to avoid your shares being considered broker non-votes.

Limitation on Voting

Our Certificate of Incorporation provides that in no event will any person who beneficially owns more than 10% of the then-outstanding shares of Common Stock be entitled or permitted to vote any of the shares of Common Stock held in excess of the 10% limit.

Important Notice Regarding Internet Availability of Proxy Materials For the Stockholder Meeting to be Held on May 25, 2022

This Proxy Statement and the 2021 Annual Report on Form 10-K are available at https://ir.northshoretrust.com/sec-filings/all-sec-filings.

PROPOSAL I – ELECTION OF DIRECTORS

Our Board of Directors is comprised of seven members. Our Certificate of Incorporation provides that directors are divided into three classes, with one class of directors elected annually. Two directors have been nominated for election at the Annual Meeting to serve for a three-year period and until their respective successors shall have been elected and qualified. The Board of Directors has nominated Kevin M. Dolan and Thomas M. Ivantic, each to serve as a director for a three-year term. Each nominee is currently a director of NSTS Bancorp, Inc. and has agreed to serve as a director if elected.

It is intended that the proxies solicited on behalf of the Board of Directors (other than proxies in which the vote is withheld as to any nominee) will be voted at the Annual Meeting for the election of the proposed nominees. If a nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may determine. At this time, the Board of Directors knows of no reason why any of the nominees might be unable to serve, if elected. Except as indicated herein, there are no arrangements or understandings between any nominee or continuing director and any other person pursuant to which such nominee or continuing director was selected.

The following sets forth certain information regarding the nominees, the other current members of our Board of Directors, and executive officers who are not directors. Age information is as of March 31, 2022, and term as a director includes service with the Bank. With respect to directors and nominees, the biographies contain information regarding the person’s business experience and the experiences, qualifications, attributes or skills that caused the Board of Directors to determine that the person should serve as a director. Each director of the Company is also a director of the Bank.

Directors Nominated for a Term Expiring in 2025:

Kevin M. Dolan, age 64, has served as a director since March 2021. Mr. Dolan retired from Abbott Laboratories in 2012 after 33 years of having served in a number of finance and accounting roles including Vice President and Controller for Tap Pharmaceuticals, a joint venture between Abbott and Takeda Chemicals of Japan, and Vice President and Controller of the U.S. Pharmaceutical Division. He received his BBA in finance from the University of Notre Dame in 1979 and a Masters in Management degree from Northwestern University in 1985. Mr. Dolan has served as an elected Commissioner for the Mundelein Park and Recreation District from 1997 to the present. He also served as a Trustee on the Illinois Association of Park Districts’ Board of Trustees from 2013 until 2021, serving as Chairman in 2019. Mr. Dolan’s role as an executive of a large pharmaceutical company, his financial and accounting background, and his community involvement make him a valuable contributor to the Board of Directors.

Thomas M. Ivantic, age 70, has served as a director since 1998. Mr. Ivantic is currently retired. Mr. Ivantic previously served for over 29 years as a commercial airline pilot for United Airlines. Mr. Ivantic is a 1973 graduate of St. Mary’s University, Winona, Minnesota, in both Economics and Business Administration. Mr. Ivantic volunteers in many local groups, including Boy Scouts of America, PADS, and Appalachia Service Project. Mr. Ivantic’s business experience in the airline industry and long-term service with United Airlines and with North Shore MHC, the predecessor of NSTS Bancorp, Inc., and his community involvement makes him a valuable contributor to our Board.

The Board of Directors unanimously recommends a vote “FOR” each of the above nominees for director.

Directors Whose Term Expires in 2023:

Apolonio Arenas, age 51, has served as a director since 2006. Mr. Arenas also serves as the President of Dieck, Arenas and Associates PC. A certified public accountant since 1996, Mr. Arenas has held various accounting roles in his 29 years of service with Dieck, Arenas and Associates PC. Mr. Arenas attended Saint Xavier University and received a Bachelor’s in Accountancy in 1992. Mr. Arenas serves on the board of directors of All Are Welcome Social Services, Inc. Mr. Arenas previously served on the school board of the Most Blessed Trinity Academy. Mr. Arenas’ over 29 years of experience as a public accountant is an important skill set to have on the Board of Directors. In addition, his community involvement makes him a valuable contributor to the Board of Directors.

Thomas J. Kneesel, age 67, has served as a director since March 2020. Mr. Kneesel is the current President/Owner of Kneesel and Associates, a residential appraisal firm. Mr. Kneesel previously served as the Vice President and Residential Appraisal Compliance Officer of Associated Bank, N.A., Green Bay, Wisconsin from 2011-2020. Mr. Kneesel is currently the Chairman of the Wisconsin Real Estate Appraisal Advisory Board and of the Wisconsin Real Estate Appraiser Board. Mr. Kneesel currently holds the SRA and AI-RRS designations granted by the Appraisal Institute. Mr. Kneesel holds a degree in business from St. Mary’s University, Winona, Minnesota in 1977. Mr. Keesel’s role as the President/Owner of a residential appraisal firm and his knowledge of the residential real estate market provide an important resource to the Board of Directors and management.

Rodney J. True, age 69, has served as director since March 2003. Mr. True is currently retired. Mr. True previously served as Chief Operating Officer of Spend Radar, a software development company located in Chicago, Illinois, for seven years from 2008 to 2015, and prior to that, as Chief Executive Officer of TrueSource, a spend analysis software company. Mr. True also held various management positions with Ernst & Young, Abbott Laboratories, and Republic Steel. Mr. True received a Master’s Degree in Business Administration with the valedictorian distinction from the Lake Forest Graduate School of Management in 1983, and received a Bachelor’s of Arts in Economics from Ripon College, Ripon, Wisconsin, in 1974. Mr. True’s prior experience as the Chief Operating Officer and Chief Executive Officer of software development companies provides an important resource to the Board of Directors and management.

Directors Whose Term Expires in 2024:

Stephen G. Lear, age 66, has served as the Chairman of the Board of Directors of North Shore MHC, the predecessor to NSTS Bancorp, Inc., and North Shore Trust and Savings since 2012 and as a director since 2003. Mr. Lear has also served as the Chief Executive Officer of North Shore Trust and Savings since 1998. Mr. Lear has served in varying capacities with North Shore Trust and Savings since 1979. Mr. Lear received a degree in Finance/Business Administration from the University of Illinois at Urbana-Champaign and his MBA from the Lake Forest Graduate School of Management in Lake Forest, Illinois. He previously served on the Board of Directors and as Chairman of the Illinois League of Financial Institutions. Mr. Lear has over 40 years of service in the financial services industry and over 20 years of service as the Chief Executive Officer of North Shore Trust and Savings. Mr. Lear’s experience makes him an important component of the Board of Directors and an effective Chairman of the Board.

Thaddeus M. Bond, Jr., age 56, has served as a director since 2015. Mr. Bond is the founder of the Law Offices of Thaddeus M. Bond, Jr. & Associates, P.C. and Bond Title Services, Inc. A licensed attorney since 1991, Mr. Bond concentrates his practice in the areas of real estate law, civil litigation, real estate-based litigation, estate planning and probate law. Mr. Bond is a lifelong Lake County, Illinois resident. Mr. Bond attended Augustana College in Rock Island, Illinois and the John Marshall Law School (now the University of Illinois-Chicago Law School), graduating with honors. Mr. Bond has served on the board of directors at his alma mater, Carmel Catholic High School, including two years as board chair. Mr. Bond also serves on the board of directors of the Special Recreation Association of Central Lake County Foundation, a fundraising arm for an organization which provides recreational activities for special needs children and adults. Mr. Bond’s experience as the founding attorney of a local law firm serving the Bank’s community provides a legal resource to the Board and management.

Executive Officers Who are Not Directors

Nathan E. Walker, age 43, has served as the President and Chief Operating Officer of North Shore Trust and Savings since November 2020. Mr. Walker joined North Shore Trust and Savings in 1996 and has previously held roles as Chief Operating Officer and Senior Vice President of Retail Banking between 2010 and 2020. Mr. Walker holds a Bachelor’s of Science degree in Finance from the University of Wisconsin-Parkside, a Master’s degree in Business Administration from Cardinal Stritch University and an advanced degree from the Graduate School of Banking at the University of Wisconsin Madison. Mr. Walker serves on the board of directors of Siena Catholic Schools of Racine, Wisconsin.

Amy L. Avakian, age 61, has served as the Vice President and Chief Lending Officer of North Shore Trust and Savings from 2019 to present. Ms. Avakian began her career at North Shore Trust and Savings in 1983 and has served in various roles within the lending function and is a member of the loan committee. Ms. Avakian received her Bachelor’s in Communication from St. Norbert College in De Pere, Wisconsin. Ms. Avakian is a member of the Lake County Property Investors Association.

Carissa H. Schoolcraft, age 30, has served as the Chief Financial Officer of North Shore Trust and Savings since April 2021. Ms. Schoolcraft previously served as the Controller of North Shore Trust and Savings from April 2020 to April 2021. Prior to joining North Shore Trust and Savings, Ms. Schoolcraft served as a Staff Auditor (Manager) at KPMG, LLP from 2013 to 2020. Ms. Schoolcraft received a Bachelor’s and Master’s Degree in Accounting from Truman State University in Kirksville, Missouri.

Board Independence

The Board of Directors has determined that each of our directors, other than Stephen G. Lear, Thomas M. Ivantic, and Thomas J. Kneesel, is considered independent under the Nasdaq Stock Market corporate governance listing standards. Director Lear is not considered independent because he serves as the Chief Executive Officer of NSTS Bancorp, Inc. and North Shore Trust and Savings. Director Ivantic is not considered independent because he is the brother of Amy L. Avakian, our Chief Lending Officer. Director Kneesel is not considered independent because he is the brother-in-law of Ms. Avakian. In determining the independence of our directors, the Board of Directors considered relationships between North Shore Trust and Savings and our directors that are not required to be reported under “Transactions With Certain Related Persons” below, consisting of deposit accounts that our directors maintain at North Shore Trust and Savings. The Board of Directors also considered current and prior relationships that each non-employee director may have with NSTS Bancorp, Inc. and North Shore Trust and Savings, including certain services provided by Director Bond’s law firm, of which he is the owner, and the lease of office space from North Shore Trust and Savings by Dieck, Arenas and Associates PC, for which Director Arenas serves as President, and all other facts and circumstances our Board of Directors deemed relevant in determining independence and found that none had a relationship that would preclude a finding of independence under applicable Nasdaq listing standards.

Board Leadership Structure and Risk Oversight

The Board of Directors currently combines the position of Chairman of the Board with the position of an executive officer. The Board of Directors believes this provides an efficient and effective leadership model for the Company. Combining the Chairman of the Board and executive officer positions fosters clear accountability, effective decision-making, and alignment on corporate strategy. To assure effective independent oversight, the Board has adopted a number of governance practices, including a majority of the independent directors on the Board of Directors, and the Compensation Committee conducting performance evaluations of the Chairman of the Board.

The Board of Directors recognizes that, depending on the circumstances, other leadership models might be appropriate. Accordingly, the Board of Directors periodically reviews its leadership structure.

The Board of Directors is actively involved in oversight of risks that could affect NSTS Bancorp, Inc. This oversight is conducted primarily through committees of the Board of Directors, but the full Board of Directors has retained responsibility for general oversight of risks. The Board of Directors also satisfies this responsibility through reports by the committee chair of all board committees regarding the committees’ considerations and actions, through review of minutes of committee meetings and through regular reports directly from officers responsible for oversight of particular risks within NSTS Bancorp, Inc. The Board of Directors of North Shore Trust and Savings also has additional committees that conduct risk oversight. All committees are responsible for the establishment of policies that guide management and staff in the day-to-day operation of NSTS Bancorp, Inc. and North Shore Trust and Savings such as lending, risk management, asset/liability management, investment management and others.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons owning more than 10% of a registered class of our equity securities, to file with the Securities and Exchange Commission (“SEC”) reports of ownership and changes in ownership of the Company’s equity securities on Forms 3, 4 and 5 (“Section 16(a) Reports”). Based on a review of Section 16(a) Reports filed with the SEC and written representations, if any, from our directors and executive officers that no Form 5 filings were required, we believe that, with respect to the 2021 fiscal year, all required Section 16(a) Reports were timely made, with the exception of a Form 3 filed for Kevin M. Dolan on January 20, 2022.

Code of Ethics for Senior Officers

NSTS Bancorp, Inc. has adopted a Code of Ethics for Senior Officers that applies to NSTS Bancorp, Inc.’s principal executive officer, principal financial officer, or persons performing similar functions. The Code of Ethics for Senior Officers is available under the “Investor Relations” section of our website, www.northshoretrust.com. Amendments to and waivers from the Code of Ethics for Senior Officers will also be disclosed on our website.

It is expected that all directors, officers and employees act in accordance with the highest standards of personal and professional conduct in all aspects of their employment and association with the Company and the Bank, to comply with all applicable laws, rules and regulations and to adhere to all policies and procedures adopted by the Company and the Bank.

Anti-Hedging Policy

Pursuant to the Company’s insider trading policy, directors, officers and employees of the Company or the Bank, and their affiliated persons, are prohibited from entering into hedging or monetization transactions or similar arrangements (including prepaid variable forward contracts, equity swaps, collars, and exchange funds) that hedge or offset, or are designed to hedge or offset, any decrease in the market value of Company’s securities they may hold.

Attendance at Annual Meetings of Stockholders

The Company does not have a written policy regarding director attendance at annual meetings of stockholders, although all directors are expected to attend our annual meetings of stockholders absent unavoidable scheduling conflicts. The 2022 Annual Meeting will the Company’s first annual stockholder meeting.

Communications with the Board of Directors

The Board of Directors and management encourage communication from our stockholders. Any stockholder who wishes to contact our Board of Directors or an individual director may do so by writing to: NSTS Bancorp, Inc., 700 S. Lewis Avenue, Waukegan, Illinois 60085, Attention: Board of Directors. Communications are reviewed by the Corporate Secretary and are then distributed to the Board of Directors or the individual director, as appropriate, depending on the facts and circumstances outlined in the communications received. The Corporate Secretary may attempt to handle an inquiry directly (for example, where it is a request for information at NSTS Bancorp, Inc. or it is a stock-related matter). The Corporate Secretary has the authority not to forward a communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate. At each Board of Directors meeting, the Corporate Secretary will present a summary of all communications received since the last meeting that were not forwarded and make those communications available to the Directors on request.

Meetings and Committees of the Board of Directors

The Board of Directors has established standing committees, including an Audit Committee, a Nominating and Corporate Governance Committee and a Compensation Committee. Each of these committees operates under a written charter, which governs its composition, responsibility and operations. The charters are available on the “Investor Relations” page of the Company’s website, www.northshoretrust.com. The table below sets forth the members of each of the listed standing committees.

|

Audit Committee |

Nominating and Corporate |

Compensation Committee |

||

|

Apolonio Arenas (Chair) |

Rodney J. True (Chair) |

Kevin M. Dolan (Chair) |

||

|

Kevin M. Dolan |

Apolonio Arenas |

Thaddeus M. Bond, Jr. |

||

|

Rodney J. True |

Thaddeus M. Bond, Jr. |

Apolonio Arenas |

Audit Committee. The Audit Committee meets periodically with the independent registered public accounting firm and management to review accounting, auditing, internal control structure and financial reporting matters. The committee also receives and reviews the reports and findings and other information presented to them by NSTS Bancorp, Inc.’s officers regarding financial reporting policies and practices. The Audit Committee also reviews the performance of NSTS Bancorp, Inc.’s independent registered public accounting firm, the internal audit function and oversees policies associated with financial risk assessment and risk management. The Audit Committee selects the independent registered public accounting firm and meets with them to discuss the results of the annual audit and any related matters. The Board of Directors believes that Director Arenas qualifies as an “audit committee financial expert” as such term is defined by the rules and regulations of the Securities and Exchange Commission.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for, among other things, assisting the Board of Directors in identifying qualified individuals to become Board members, in determining the size and composition of the Board and its committees, in monitoring a process to assess Board effectiveness and in developing and implementing the Company’s corporate governance guidelines.

The process for identifying and evaluating potential Board nominees includes soliciting recommendations from directors and officers of the Company. Additionally, the Board will consider persons recommended by stockholders of the Company in selecting the Board’s nominee for election. Other than with respect to the provisions related to Mr. Lear’s nomination as a director under his employment agreement, there is no difference in the manner in which persons recommended by directors or officers versus persons recommended by stockholders in selecting Board nominees are evaluated.

Only persons who are nominated in accordance with the procedures set forth in our Bylaws will be eligible for election as directors. Nominations of persons for election to the Board of Directors of the Company may be made at a meeting of stockholders at which directors are to be elected only (i) by or at the direction of the Board of Directors or (ii) by any stockholder of the Company entitled to vote for the election of directors at the meeting who complies with the notice procedures set forth in the Bylaws. See “Stockholder Proposals and Nominations” for a discussion of how stockholders can seek to nominate persons for director.

Compensation Committee. The Compensation Committee assists the Board in fulfilling the Board’s responsibilities relating to the compensation and benefits provided to the Company’s executive management. The Committee also is authorized to review, evaluate and determine, and where warranted or appropriate, make recommendations to the Board for its determination, as to various benefit plans and the overall compensation for the Company and its wholly owned subsidiaries. In particular, the Compensation Committee establishes and approves the objectives relevant to the compensation paid to our Chief Executive Officer. The Chief Executive Officer may make recommendations to the Compensation Committee from time to time regarding the appropriate mix and level of compensation for officers of the Company and the Bank, however, he does not provide recommendations with respect to, and is not present during any committee deliberations or voting on, his compensation. The Compensation Committee also assists the Board of Directors in succession planning and management development for executive officers. The Compensation Committee also considers the appropriate levels and form of director compensation and makes recommendations to the Board of Directors regarding director compensation.

Transactions with Certain Related Persons

Federal law generally prohibits publicly traded companies from making loans to their executive officers and directors, but it contains a specific exemption from the prohibition for loans made by federally insured financial institutions, such as North Shore Trust and Savings, to their executive officers and directors in compliance with federal banking regulations. At December 31, 2021, all of our loans to directors and executive officers were made in the ordinary course of business, were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to North Shore Trust and Savings, and did not involve more than the normal risk of collectability or present other unfavorable features. These loans were performing according to their original repayment terms at December 31, 2021 and were made in compliance with federal banking regulations.

Other than the loans described above, North Shore Trust and Savings has not entered into any transactions since January 1, 2020, and NSTS Bancorp, Inc. has not entered into any transactions since its incorporation in September 2021, in which the amount involved exceeded $120,000 and in which any related persons had or will have a direct or indirect material interest.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the beneficial ownership of our Common Stock as of March 31, 2022 by the following individuals or entities:

|

● |

each person known to us that owns more than 5% of the outstanding shares of Common Stock; |

|

● |

each of our directors and named executive officers; and |

|

● |

all directors and executive officers of the Company as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. Except as otherwise indicated, each person named in the table has sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned, subject to any applicable community property laws. As of March 31, 2022, 5,397,959 shares of Common Stock were outstanding. There are no shares of Common Stock that are subject to equity awards outstanding.

The address for each of our directors and executive officers is 700 S. Lewis Avenue, Waukegan, Illinois 60035.

|

Shares of Common Stock Beneficially Owned as of the Record Date |

Percent of Shares of Common Stock Outstanding |

||

| Persons Owning Greater than 5% | |||

| North Shore Trust and Savings ESOP Trust | |||

| 700 S. Lewis Ave. | |||

| Waukegan, IL 60085 | 431,836 | 8.0% | |

| Directors | |||

| Stephen G. Lear | 30,000 | * | |

| Apolonio Arenas | 17,500 | * | |

| Thaddeus M. Bond | 30,000 | * | |

| Kevin M. Dolan | 30,000 | * | |

| Thomas M. Ivantic | 20,000 | * | |

| Thomas J. Kneesel | 20,000 | * | |

| Rodney J. True | 30,000 | * | |

| Non-Director Named Executive Officers | |||

| Nathan E. Walker | 30,000 | * | |

| Amy L. Avakian | 30,000 | * | |

| Carissa H. Schoolcraft | 5,000 | * | |

| All Directors and Executive Officers as a group (10 persons) | 242,500 | 4.5% |

* Less than one percent

Executive and Director Compensation

Executive Compensation

The following tables set forth certain information as to the compensation paid by North Shore Trust and Savings to its Chief Executive Officer, Stephen G. Lear, and our other named executive officers for the years ended December 31, 2020 and 2021.

|

Summary Compensation Table |

|||||||||||||||||

|

Name and principal position |

Year |

Salary |

Bonus(1) |

All Other Compensation(2) ($) |

Total |

||||||||||||

|

Stephen G. Lear |

2021 |

$ | 207,199 | $ | 20,000 | $ | 137,399 | $ | 364,598 | ||||||||

| Chief Executive Officer |

2020 |

207,199 | 19,075 | 132,927 | 359,201 | ||||||||||||

|

Nathan E. Walker (6) |

2021 |

170,000 | 14,000 | 25,760 | 209,760 | ||||||||||||

| President and Chief Operating Officer |

2020 |

137,957 | 13,192 | 24,712 | 175,861 | ||||||||||||

|

Amy L. Avakian |

2021 |

133,654 | 13,000 | 27,349 | 174,003 | ||||||||||||

| Chief Lending Officer |

2020 |

131,460 | 13,000 | 8,807 | 153,267 | ||||||||||||

| (1) | Amounts in this column represent a discretionary bonus earned in recognition for performance in the prior year. |

| (2) | The amounts in this column reflect what North Shore Trust and Savings paid for, or reimbursed, the applicable named executive officer for the various benefits and perquisites received. Perquisites received include club dues. This column does not reflect perquisites and personal benefits received by our named executive officers, the aggregate value of which is less than $10,000. A breakdown of the various elements of compensation in this column for calendar year 2021 is set forth in the following table: |

|

All Other Compensation |

||||||||||||||||||||||||

|

Name |

401(k) Match |

Board Fees(3) |

Directors’ Retirement Plan(4) |

Equity Value Plan(5) |

Perquisites received |

Total All Other Compensation |

||||||||||||||||||

|

Stephen G. Lear |

$ | 13,630 | $ | 32,000 | $ | 15,581 | $ | 61,500 | $ | 14,688 | $ | 137,399 | ||||||||||||

|

Nathan E. Walker |

10,235 | — | — | 15,525 | 25,760 | |||||||||||||||||||

|

Amy L. Avakian |

8,799 | — | — | 18,550 | 27,349 | |||||||||||||||||||

| (3) | Mr. Lear deferred 50% of 2021 Board fees into the Non-Qualified Deferred Compensation Plan. |

| (4) | North Shore Trust and Savings maintained a Directors’ Retirement Plan which provided for post-retirement benefits to directors who have served North Shore Trust and Savings for a minimum of six years. Benefits under the Directors’ Retirement Plan were accrued during the period of service. The Directors’ Retirement Plan was terminated in December 2019 and contributions received in 2019 were the final contributions for the plan. The Directors’ Retirement Plan began distributions in 2020 and completed distributions in 2021. All required amounts were fully accrued at December 31, 2019. |

| (5) | North Shore Trust and Savings’ Equity Value Plan (the “Equity Value Plan”) was established in 2005 and covered key officers and directors. Under the terms of the Equity Value Plan, participants were granted units that entitled the holder to receive the appreciation in the value of the unit from the grant date through termination of employment. Benefits vested over five years. The value of the unit was based on the change in the value of North Shore MHC’s, the predecessor to NSTS Bancorp, Inc., equity. The Equity Value Plan was terminated in December 2019 and contributions received in 2019 were the final contributions for the Equity Value Plan. The Equity Value Plan began distributions in 2020 and completed such distributions in January 2021. All required amounts were fully accrued at December 31, 2019. |

| (6) | Appointed President of North Shore Trust and Savings in December 2020. Amounts reported for 2020 reflect Mr. Walker's salary as Chief Operating Officer of North Shore Trust and Savings from January 1, 2020 through November 30, 2020 and Mr. Walker's compensation as President of North Shore Trust and Savings from December 1, 2020 through December 31, 2020. |

None of the named executive officers held any outstanding equity awards as of December 31, 2021.

Benefit Plans and Agreements

Employment Agreements. At the closing of the offering, in January 2022, NSTS Bancorp, Inc. and North Shore Trust and Savings entered into an employment agreement with Mr. Lear. Pursuant to the agreement, Mr. Lear will continue to serve in his current capacity as the Chairman, President and Chief Executive Officer of NSTS Bancorp, Inc. and as Chairman and Chief Executive Officer of North Shore Trust and Savings. The employment agreement has an initial term of three years. The initial term of the employment agreement will extend automatically for one additional year on each anniversary of the effective date of the agreement, so that the remaining term is again three years, unless one party gives the other party written notice of non-renewal at least 90 days prior to the applicable anniversary date. The employment agreement provides that his base salary may be increased, but not decreased, at the discretion of the boards of directors. In addition to the base salary, the agreement provides that Mr. Lear will be eligible to receive an annual bonus as may be determined by the board of directors. Mr. Lear is also eligible to participate in any other short-term incentive compensation plan or long-term or equity incentive plans that may be adopted by the board of directors. Mr. Lear is also entitled to participate in all employee benefit plans, arrangements and perquisites offered to our employees and officers, and the reimbursement of reasonable business expenses incurred in the performance of his duties. We will also provide Mr. Lear with reimbursement for monthly membership dues at a country club or similar club, and may provide other perquisites such as an automobile allowance and/or cell phone expense reimbursement as determined by the board of directors.

The employment agreement is terminable with or without cause by us. Mr. Lear has no right to compensation or other benefits pursuant to the employment agreement for any period after termination for cause, as defined in the agreement. In the event we terminate Mr. Lear’s employment without cause or Mr. Lear voluntary resigns for “good reason” (i.e., a “qualifying termination event”), we will pay Mr. Lear a severance payment equal to the base salary that Mr. Lear would have received had he continued employment for the remainder of the then-current term. The severance payment will be paid as salary continuation in substantially equal installments in accordance with our regular payroll practice over the remainder of the then-current term. Mr. Lear must sign a general release of claims to receive the severance payment. A “good reason” condition for purposes of the employment agreement includes a material reduction in base salary, a material adverse change in responsibilities, titles, powers or duties, a failure to appoint Mr. Lear as a director of North Shore Trust and Savings or a failure to nominate Mr. Lear to stand for election to NSTS Bancorp, Inc.’s board of directors, relocation of Mr. Lear’s principal place of employment to a location more than 25 miles from his current principal place of employment, or material breach of the employment agreement by us.

If a qualifying termination event occurs within 24 months following a change in control of NSTS Bancorp, Inc. or North Shore Trust and Savings, Mr. Lear would be entitled to (in lieu of the payments and benefits described in the previous paragraph) a severance payment equal to two and one-half times the sum of (i) Mr. Lear’s base salary, plus (ii) the average annual bonus earned by Mr. Lear for the three (3) years immediately preceding the year in which the change in control occurs. This change in control severance will be paid in a lump sum payment. Mr. Lear must sign a general release of claims to receive the change in control severance payment.

The employment agreement terminates upon Mr. Lear’s death, and in such event, his estate or beneficiary will be paid his accrued benefits through such date. Also, upon termination of employment, Mr. Lear will be required to adhere to a one-year non-solicitation restriction set forth in his employment agreement.

Change in Control Agreements. At the closing of the offering, in January 2022, North Shore Trust and Savings entered into a change in control agreement with each of Mr. Walker and Ms. Avakian and Ms. Schoolcraft. The change in control agreements have an initial term of three years. The initial term of the change in control agreements extends automatically for one additional year on each anniversary of the effective date of the agreement. If North Shore Trust and Savings terminates the executive’s employment, the change in control agreement will terminate upon such termination of employment. Notwithstanding the foregoing, in the event a change in control event occurs during the term of a change in control agreement, the term of the agreement will automatically extend for the greater of 12 months from the change of control event or until all benefits then due and owing are paid to the executive.

Upon termination of the executive’s employment by North Shore Trust and Savings without “cause” or by the executive with “good reason” on or after the effective date of a change in control of North Shore Trust and Savings or NSTS Bancorp, Inc., Mr. Walker would be entitled to a severance payment equal to two times the sum of (i) his base salary; and (ii) his average annual bonus earned for the three (3) years immediately preceding the year in which the change in control occurs. Ms. Avakian and Ms. Schoolcraft each would be entitled to a severance payment equal to 1.5 times the sum of (i) her base salary; and (ii) her average annual bonus earned for the three (3) years immediately preceding the year in which the change in control occurs. This change in control severance will be paid in substantially equal installments over a 12-month period. In addition, the executive would receive continuation of medical, dental or other health coverage, at the same premium cost to executive, for twelve months following termination of employment. The executive must sign a general release of claims to receive the change in control severance payment.

A “good reason” condition for purposes of the change in control agreements includes a material reduction in base salary, a material adverse change in the responsibilities, powers or duties of executive, or a relocation of the executive’s principal place of employment to a location more than 25 miles from his/her current principal place of employment.

401(k) Plan

North Shore Trust and Savings sponsors the North Shore Trust and Savings 401(k) Plan (“401(k) Plan”), which is a qualified, tax-exempt defined contribution plan with a salary deferral feature under Section 401(k) of the Internal Revenue Code. An employee of North Shore Trust and Savings is eligible to become a participant in the plan after reaching age 18 and completing three months of employment. Eligible employees are entitled to enter the 401(k) Plan on a monthly basis.

Under the 401(k) Plan, during 2021 participants were permitted to make salary deferral contributions (in whole percentages or specific dollar amounts) in any amount up to 100% of their plan salary up to the maximum percentage of compensation allowed by law ($19,500 for 2020). Participants who are age 50 or older are permitted to make “catch up” contributions to the plan up to $6,500 (for 2020, as indexed annually). North Shore Trust and Savings currently contributes a matching contribution amount equal to 100% of the participant’s elective deferral up to 6%. North Shore Trust and Savings may also make a discretionary, fully vested profit sharing contribution to the 401(k) Plan. Upon termination of employment, including following retirement or disability, a participant may withdraw his or her vested account balance.

Noncontributory Profit-Sharing Plan

North Shore Trust and Savings sponsors a noncontributory profit sharing plan covering all employees who have worked more than 1,000 hours during the plan year and remain employed as of the year-end. Funds are fully vested after two years of employment. Profit sharing expense for the years ended 2021 and 2020 was $0.

Employee Stock Ownership Plan.

North Shore Trust and Savings established the ESOP for its employees which became effective upon completion of the conversion of North Shore MHC into the stock holding company form of organization and the related stock offering by the Company in January 2022 (the “Conversion”). Employees who have been credited with at least 1,000 hours of service during a 12-month period and who have attained age 18 are eligible to participate in the employee stock ownership plan.

As part of the Conversion, in order to fund the purchase of up to 8.0% of the common stock issued in the Conversion (including shares contributed to the charitable foundation), or 431,836 shares, the ESOP borrowed funds from NSTS Bancorp, Inc. The Company has agreed to loan the employee stock ownership plan the funds necessary to purchase shares. The loan to the ESOP has a term of 25 years, to be repaid principally from North Shore Trust and Savings contributions to the ESOP, and the collateral for the loan is the Common Stock purchased by the ESOP. The interest rate for the ESOP loan is 3.25%. NSTS Bancorp, Inc. may, in any plan year, make additional discretionary contributions for the benefit of plan participants in either cash or shares of Common Stock, which may be acquired through the purchase of outstanding shares in the market or from individual stockholders, upon the original issuance of additional shares by NSTS Bancorp, Inc. or upon the sale of treasury shares by NSTS Bancorp, Inc. Such purchases, if made, would be funded through additional borrowings by the ESOP or additional contributions from North Shore Trust and Savings. The timing, amount and manner of future contributions to the ESOP will be affected by various factors, including prevailing regulatory policies, the requirements of applicable laws and regulations and market conditions.

Shares purchased by the ESOP with the loan proceeds are held in a suspense account and released for allocation to participants on a pro rata basis as debt service payments are made. Shares released from the ESOP will be allocated to each eligible participant’s ESOP account based on the ratio of each such participant’s compensation, consisting of salary and bonus, to the total of such compensation of all eligible ESOP participants. Forfeitures may be used for several purposes such as the payment of expenses or be reallocated among remaining participating employees. Account balances of participants in the ESOP plan will be 100% vested after five years of service. Credit is given for years of service with North Shore Trust and Savings prior to adoption of the ESOP. In the case of a “change in control,” as defined in the ESOP, however, participants will become immediately fully vested in their account balances. Participants will also become fully vested in their account balances upon death, disability or retirement. Benefits may be payable upon retirement or separation from service.

GAAP requires that any third-party borrowing by the ESOP be reflected as a liability on our statement of financial condition. Since the ESOP is borrowing from NSTS Bancorp, Inc., the loan will not be treated as a liability but instead will be excluded from stockholders’ equity.

Our ESOP will be subject to the requirements of the Employee Retirement Income Security Act of 1974, as amended, and the applicable regulations of the IRS and the Department of Labor.

Director Compensation

Each of the current directors of the Company also serves as a director of the Bank, and prior to the Conversion, also served as a director of North Shore MHC and NSTS Financial Corporation. During 2021, each director of the Bank received an annual retainer of $18,000 and a per meeting fee of $1,000. Each director received an additional annual retainer of $1,000 (paid in quarterly installments) for their service on each of the boards of directors of North Shore MHC and NSTS Financial Corporation. Following the completion of the Conversion in January 2022, (i) no changes were implemented in the amount of fees each director receives for service on the board of directors of the Bank; and (ii) in lieu of the additional retainer directors received for service on the board of directors of North Shore MHC and NSTS Financial Corporation, each director receives an additional annual retainer of $2,000 (paid in quarterly installments) for his or her service on the board of directors of the Company.

The following table sets forth total compensation paid to directors for their service on the boards of directors of the Bank, North Shore MHC, NSTS Financial Corporation and the Company during the year ended December 31, 2021, other than to directors who are also named executive officers. Information with respect to director compensation paid to directors who are also named executive officers is included above in “-Executive Officer Compensation – Summary Compensation Table.”

|

Name |

Fees Earned or Paid in Cash(1) |

All Other Compensation(2) |

Total |

|||||||||

|

Apolonio Arenas |

$ | 32,000 | $ | 12,831 | $ | 62,581 | ||||||

|

Thaddeus M. Bond Jr. |

32,000 | 4,583 | 44,458 | |||||||||

|

Kevin M. Dolan(3) |

25,000 | — | 25,000 | |||||||||

|

Thomas M. Ivantic |

32,000 | 20,163 | 72,663 | |||||||||

|

Thomas J. Kneesel |

32,000 | — | 32,000 | |||||||||

|

Rodney J. True |

32,000 | 15,581 | 68,081 | |||||||||

| (1) |

Messrs. Bond, Ivantic and True deferred all or a portion of their fees into a deferred compensation account pursuant to the Director Deferred Compensation Plan described below. |

| (2) |

The amounts in this column reflect what North Shore Trust and Savings paid for, or reimbursed, the applicable directors for the various benefits and perquisites received. This column does not reflect perquisites and personal benefits received by our directors, the aggregate value of which is less than $10,000. North Shore Trust and Savings maintained a Directors’ Retirement Plan which provided for post-retirement benefits to directors who have served North Shore Trust and Savings for a minimum of six years. Benefits under the plan were accrued during the period of service. The final accrual occurred in 2019. The plan had final payouts in 2021.North Shore Trust and Savings’ Equity Value Plan was established in 2005 and covered key officers and directors. Under the terms of the plan, participants were granted units that entitled the holder to receive the appreciation in the value of the unit from the grant date through termination of employment. Benefits vested over five years. The value of the unit was based on the change in the value of North Shore MHC’s equity. The final accrual occurred in 2019. The plan had final payouts in 2021. A breakdown of the various elements of compensation in this column for calendar year 2021 is set forth in the following table: |

|

Name |

Directors' Retirement Plan |

Equity Value Plan |

Total |

|||||||||

|

Apolonio Arenas |

$ | 12,831 | $ | 17,750 | $ | 30,581 | ||||||

|

Thaddeus M. Bond Jr. |

4,583 | 7,875 | 12,458 | |||||||||

|

Kevin M. Dolan |

— | — | — | |||||||||

|

Thomas M. Ivantic |

20,163 | 20,500 | 40,663 | |||||||||

|

Thomas J. Kneesel |

— | — | — | |||||||||

|

Rodney J. True |

15,581 | 20,500 | 36,081 | |||||||||

| (3) |

Mr. Dolan joined the board of directors of each of North Shore MHC, NSTS Financial Corporation and North Shore Trust and Savings in March 2021. |

Director Deferred Compensation Plan

We maintain a non-qualified unsecured director deferred compensation plan that allows directors of each North Shore MHC, NSTS Financial Corporation and North Shore Trust and Savings to elect to defer up to 100% of the retainer and monthly board fees. We establish a deferred compensation account for each participating director and credits the account with the fees deferred by the director plus interest equal to the prime rate plus two percent. Interest is credited to each such account quarterly.

PROPOSAL II

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of NSTS Bancorp, Inc. has approved the engagement of Plante & Moran PLLC to be the Company’s independent registered public accounting firm for the year ending December 31, 2022. At the Annual Meeting, stockholders will consider and vote on the ratification of the Audit Committee’s engagement of Plante & Moran PLLC for the year ending December 31, 2022. A representative of Plante & Moran PLLC is expected to attend the annual meeting and may respond to appropriate questions and make a statement if he or she so desires.

The Audit Committee is responsible for the appointment and oversight of the Company’s independent registered public accounting firm. Even if the engagement of Plante & Moran PLLC is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such change would be in the best interests of the Company and its stockholders.

The Board of Directors recommends a vote “FOR” the ratification of Plante & Moran PLLC as independent registered public accounting firm for the year ending December 31, 2022.

Matters Relating to Fees Paid to Independent Registered Accounting Firm

Set forth below is certain information concerning aggregate fees billed for professional services rendered by Plante & Moran PLLC during the years ended December 31, 2021 and 2020, as well as all out-of-pocket costs incurred in connection with these services that were billed to the Company or its subsidiaries:

|

Year ended December 31, 2021 |

Year ended December 31, 2020 |

|||||||

|

Audit Fees |

$ | 84,000 | $ | 48,545 | ||||

|

Audit-Related Fees |

183,892 | — | ||||||

|

Tax Fees |

18,140 | 9,050 | ||||||

|

All Other Fees |

— | — | ||||||

|

Total |

$ | 286,032 | $ | 57,595 | ||||

Audit Fees. Audit fees include aggregate fees billed for professional services for the audit of North Shore MHC’s annual consolidated financial statements, including out-of-pocket expenses.

Audit-Related Fees. Audit-Related Fees include fees billed for professional services in 2021, consisting primarily of fees billed in connection with the Company’s reorganization to the stock form of organization in 2021 and limited review of quarterly condensed consolidated financial statements during 2021 included in period reports filed with the Securities and Exchange Commission..

Tax Fees. Tax Fees include fees billed for tax compliance and tax-related fees in 2021 and 2020.

Pre-Approval of Audit and Permissible Non-Audit Services of Independent Public Accounting Firm

The Audit Committee has considered whether the provision of non-audit services, which relate primarily to tax services and public company status, is compatible with maintaining the independence of Plante & Moran PLLC. The Audit Committee concluded that performing such services does not affect the independence of Plante & Moran PLLC in performing its function as the Company’s independent registered public accounting firm.

The Audit Committee’s current policy is to pre-approve all audit and non-audit services provided by the independent registered public accounting firm, either by approving an engagement prior to the engagement or pursuant to a pre-approval policy with respect to particular services, subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Securities Exchange Act of 1934, as amended. These services may include audit services, audit-related services, tax services and other services. The Audit Committee may delegate pre-approval authority to one or more members of the Audit Committee when expedition of services is necessary. The independent registered public accounting firm and management are required to periodically report to the full Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee pre-approved 100% of audit-related fees and tax fees paid during the years ended December 31, 2021 and 2020, as indicated in the table above. Audit Committee Report

Our independent registered public accounting firm is responsible for performing an independent audit of our financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles in the United States of America (“GAAP”). The Audit Committee oversees the Company’s internal controls and financial reporting process on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the financial statements of North Shore MHC were prepared in accordance with GAAP and the Audit Committee has reviewed and discussed the financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm all matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board regarding the firm’s independence from the Company and its management, and discussed with the registered public accounting firm their independence from the Company. In concluding that the registered public accounting firm is independent, the Audit Committee considered, among other factors, whether any non-audit services provided by the firm were compatible with its independence.

The Audit Committee discussed with the independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal controls, and the overall quality of its financial reporting.

In performing these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of Company management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm which, in its report, expressed an opinion on the conformity to GAAP of North Shore MHC’s consolidated financial statements. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not assure that the financial statements are presented in accordance with GAAP, that the audit of the financial statements has been carried out in accordance with GAAP or that the independent registered public accounting firm is “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee has recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 for filing with the Securities and Exchange Commission.

This report has been provided by the Audit Committee:

Apolonio Arenas (Chair)

Kevin M. Dolan

Rodney J. True

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission under such acts.

STOCKHOLDER PROPOSALS AND NOMINATIONS

In order to be eligible for inclusion in the proxy materials for the 2023 Annual Meeting of Stockholders, any stockholder proposal to take action at such meeting much be received at NSTS Bancorp, Inc.’s executive office, 700 S. Lewis Avenue, Waukegan, Illinois 60085, no later than December 22, 2022, which is 120 days prior to the first anniversary of the date the Company expects to mail these proxy materials. If the date of the 2023 Annual Meeting of Stockholders is changed by more than 30 days, any stockholder proposal must be received at a reasonable time before the Company prints or mails proxy materials for such meeting. Any such proposals shall be subject to the requirements of the proxy rules adopted under the Securities Exchange Act of 1934.

Section 11C of our Bylaws requires that we be given advance written notice of director nominations and other matters that an eligible stockholder wishes to present for action at an annual meeting. In order to be properly brought before an annual meeting of stockholders, any new business or a director nomination proposed by a stockholder must be stated in writing, comply with the requirements of our Bylaws, and be received by the Corporate Secretary not less than 120 days prior to the date of the annual meeting. These requirements apply to all stockholder proposals and nominations, without regard to whether the proposals or nominations are required to be included in the Company’s proxy statement or form of proxy. The 2023 Annual Meeting of stockholders is expected to be held May 24, 2023. Accordingly, advance written notice for certain business, or nominations to the Board of Directors, to be brought before the next annual meeting must be given to the Company no later than January 24, 2023. If notice is received after January 24, 2023, it will be considered untimely, and we will not be required to present the matter at the stockholders meeting.

Public announcement of the date of the Annual Meeting was made on the Company’s website on April 15, 2022. To be timely under the Bylaws, nominations by any stockholder eligible to vote at the Annual Meeting must have been received by the Company not later than the close of business on the tenth day following the date on which public announcement was made, or April 25, 2022.

Nothing in this Proxy Statement shall be deemed to require the Company to include in our proxy statement and proxy relating to an annual meeting any stockholder proposal that does not meet all of the requirements for inclusion established by the Securities and Exchange Commission in effect at the time such proposal is received.

MISCELLANEOUS

Multiple Stockholders Having the Same Address

We are sending only one Proxy Statement and one Annual Report on Form 10-K for the year ended December 31, 2021 (the “Annual Report”) to the address of multiple stockholders unless we have received contrary instructions from any stockholder at that address. This practice, known as “householding,” reduces duplicate mailings, saving paper and reducing printing costs. Any stockholder residing at such an address who would like to receive an individual copy of the materials, or who is receiving multiple copies of our Proxy Statement and Annual Report and would prefer to receive a single copy in the future, you can notify us by sending a written request to NSTS Bancorp, Inc., c/o Broadridge Householding Department, 51 Mercedes Way, Edgewood, NY 11717, or by calling Broadridge at 1-866-540-7095, and we will promptly deliver additional materials as requested.

Financial and Other Information

A copy of the Company’s Annual Report will be furnished without charge to stockholders as of the record date upon written request to the Corporate Secretary or by calling (847) 336-4430. The Annual Report also can be accessed online at the Investor Relations section of the Company’s website at www.northshoretrust.com. Additionally, the Company’s Audit Committee Charter, Compensation Committee Charter, Nominating and Corporate Governance Committee Charter and Code of Ethics for Senior Officer are available without charge at the Investor Relations section of the Company’s website noted above or in print upon request by any stockholder to the Corporate Secretary at the address noted above.

Other Matters

The Board of Directors is not aware of any business to come before the annual meeting other than the matters described above in the Proxy Statement. However, if any matters should properly come before the annual meeting, it is intended that the Board of Directors, as holders of the proxies, will act as determined by a majority vote.

|

|

By Order of the Board of Directors |

|

|

|

|

|

|

|

/s/ Christine E. Stickler |

|

|

|

Christine E. Stickler |

|

|

|

Corporate Secretary |

|

Waukegan, Illinois

April 15, 2022