Respectfully submitted,

Feldman Financial Advisors, Inc.

Trent R. Feldman

President

Peter W. L. Williams

Principal

Exhibit 99.4

|

Feldman Financial Advisors, Inc. |

|

|

|

8804 Mirador Place |

|

|

McLean, VA 22102 |

|

|

(202) 467-6862 |

|

North Shore MHC Waukegan, Illinois

Conversion Valuation Appraisal Report Valued as of August 31, 2021

Prepared By

Feldman Financial Advisors, Inc. McLean, Virginia

|

|

Feldman Financial Advisors, Inc. |

|

|

|

8804 Mirador Place |

|

|

McLean, VA 22102 |

|

|

(202) 467-6862 |

August 31, 2021

Board of Directors

North Shore MHC

700 South Lewis Avenue

Waukegan, Illinois 60085

Members of the Board of Directors:

At your request, we have completed and hereby provide an independent appraisal (the “Appraisal”) of the estimated pro forma market value of North Shore MHC (the “Company”) as of August 31, 2021 in conjunction with the Company’s conversion (the “Conversion”) from the mutual holding company to stock form of organization, issuance of all of its capital stock to a newly formed stock holding company known as NSTS Bancorp, Inc. (“NSTS Bancorp”), and offering for sale of NSTS Bancorp’s common stock to eligible depositors and borrowers of North Shore Trust and Savings (the “Bank”), the Bank’s employee stock ownership plan, and certain members of the general public in the subscription and community offering (the “Stock Offering”). The Conversion is being undertaken pursuant to a Plan of Conversion adopted by the Boards of Directors of the Company, the Bank, and the mid-tier stock holding company, NSTS Financial Corporation (“NSTS Financial”). The Appraisal is furnished pursuant to the filing by the Company of applications with respect to the Conversion and the Stock Offering with the Board of Governors of the Federal Reserve System and the Office of the Comptroller of the Currency.

Feldman Financial Advisors, Inc. (“Feldman Financial”) is a financial consulting and advisory firm that specializes in valuations and analyses of business enterprises and securities in the thrift, banking, and mortgage industries. The background of Feldman Financial is presented in Exhibit I. In preparing the Appraisal, we conducted an analysis of the Company that included discussions with the Company’s management, the Company’s legal counsel, Vedder Price P.C., and the Company’s independent registered public accounting firm, Plante Moran, PLLC. In addition, where appropriate, we considered information based on other available published sources that we believe are reliable; however, we cannot guarantee the accuracy and completeness of such information. We also reviewed, among other factors, the economy in the Company’s primary market area and compared the Company’s financial condition and operating performance with that of selected publicly traded thrift institutions. We reviewed conditions in the securities markets in general and in the market for thrift institution common stocks in particular.

The Appraisal is based on the Company’s representation that the information in the Conversion applications and additional evidence furnished to us by the Company and its independent auditor are truthful, accurate, and complete. We did not independently verify the financial statements and other information provided by the Company and its independent accounting firm, nor did we independently value the assets or liabilities of the Company. The Appraisal considers the Company only as a going concern and should not be considered as an indication of the liquidation value of the Company.

Feldman Financial Advisors, Inc.

Board of Directors

North Shore MHC

August 31, 2021

Page Two

Pursuant to the Plan of Conversion, the Company will convert from the mutual holding company form of organization to the stock form of organization through the following series of steps. The Company currently owns 100% of the common stock of NSTS Financial, which in turn owns 100% of the common stock of the Bank. The Company will first merge with and into NSTS Financial which will in turn immediately merge with and into NSTS Bancorp, which in turn will sell shares of common stock in the Stock Offering. When the Conversion and Stock Offering are completed, all of the outstanding capital stock of the Bank will be owned by NSTS Bancorp, and all of the common stock of NSTS Bancorp will be owned by shareholders. The Bank will operate as a wholly-owned subsidiary of NSTS Bancorp, and the Company and NSTS Financial will both cease to exist.

The Plan of Conversion provides for the establishment of a new charitable foundation, North Shore Charitable Foundation (“the Foundation”). The Foundation will be funded initially by common stock and cash received in conjunction with the Stock Offering. The contribution to the Foundation from the net proceeds of the Stock Offering will amount to shares representing 2.0% of the total outstanding shares of common stock issued in the Conversion (including shares contributed to the Foundation) and $150,000 in cash. The purpose of the Foundation is to provide financial support to charitable organizations in the communities in which the Company operates and will operate in the future and to enable these local communities to share in the Company’s long-term growth.

It is our opinion that, as of August 31, 2021, the estimated pro forma market value of the Company was within a range (the “Valuation Range”) of $34,693,880 to $46,938,780 with a midpoint of $40,816,330. Pursuant to applicable appraisal guidelines, the Valuation Range was based upon a 15% decrease from the midpoint value to determine the minimum value and a 15% increase from the midpoint value to establish the maximum value. Assuming an additional 15% increase above the maximum value would result in an adjusted maximum of $53,979,590. Based on the Valuation Range, the range of shares to be sold in the Stock Offering (excluding the Foundation shares) is as follows: $34,000,000 at the minimum, $40,000,000 at the midpoint, $46,000,000 at the maximum, and $52,800,000 at the adjusted maximum. Based on an initial offering price of $10.00 per share, the number of shares to be sold in the Stock Offering is as follows: 3,400,000 at the minimum, 4,000,000 at the midpoint, 4,600,000 at the maximum, and 5,290,000 at the adjusted maximum.

Our Appraisal is not intended, and must not be construed, to be a recommendation of any kind as to the advisability of purchasing shares of common stock in the Stock Offering. Moreover, because the Appraisal is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of stock in the Stock Offering will thereafter be able to sell such shares at prices related to the foregoing estimate of the Company’s pro forma market value. Feldman Financial is not a seller of securities within the meaning of any federal or state securities laws, and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

Feldman Financial Advisors, Inc.

Board of Directors

North Shore MHC

August 31, 2021

Page Three

The Valuation Range reported herein will be updated as appropriate. These updates will consider, among other factors, any developments or changes in the Company’s operating performance, financial condition, or management policies, and current conditions in the securities markets for thrift institution common stocks. Should any such new developments or changes be material, in our opinion, to the valuation of the Company, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in detail at that time.

|

|

Respectfully submitted, |

|

|

|

|

|

Feldman Financial Advisors, Inc. |

|

|

|

|

|

Trent R. Feldman |

|

|

President |

|

|

|

| |

|

|

Peter W. L. Williams |

|

|

Principal |

Feldman Financial Advisors, Inc.

TABLE OF CONTENTS

|

TAB |

|

|

PAGE |

|

|

|

|

|

|

|

|

|

INTRODUCTION |

1 |

||

|

|

|

|

|

|

|

I. |

Chapter One – Business of North Shore MHC |

|

||

|

|

General Overview |

4 |

||

|

|

Financial Condition |

10 |

||

|

|

Income and Expense Trends |

18 |

||

|

|

Interest Rate Risk Management |

24 |

||

|

|

Asset Quality |

28 |

||

|

|

Office Facilities |

31 |

||

|

|

Market Area |

32 |

||

|

|

Summary Outlook |

43 |

||

|

|

|

|

|

|

|

II. |

Chapter Two – Comparisons with Publicly Traded Companies |

|

||

|

|

General Overview |

45 |

||

|

|

Selection Criteria |

46 |

||

|

|

Recent Financial Comparisons |

50 |

||

|

|

|

|

|

|

|

III. |

Chapter Three – Market Value Adjustments |

|

||

|

|

General Overview |

63 |

||

|

|

Earnings Prospects |

64 |

||

|

|

Financial Condition |

65 |

||

|

|

Market Area |

66 |

||

|

|

Management |

67 |

||

|

|

Dividend Payments |

68 |

||

|

|

Liquidity of the Stock Issue |

69 |

||

|

|

Subscription Interest |

70 |

||

|

|

Recent Acquisition Activity |

71 |

||

|

|

Effect of Banking Regulations and Regulatory Reform |

73 |

||

|

|

Stock Market Conditions |

73 |

||

|

|

Adjustments Conclusion |

80 |

||

|

|

Valuation Approach |

81 |

||

|

|

Valuation Conclusion |

84 |

||

|

|

|

|

|

|

|

IV. |

Appendix -- Exhibits |

|

||

|

|

I |

Background of Feldman Financial Advisors, Inc. |

I-1 |

|

|

|

II-1 |

Consolidated Balance Sheets |

II-1 |

|

|

|

II-2 |

Consolidated Income Statements |

II-2 |

|

|

|

II-3 |

Loan Portfolio Composition |

II-3 |

|

|

|

II-4 |

Net Lending Activity |

II-4 |

|

|

|

II-5 |

Cash and Investments Composition |

II-5 |

|

|

|

II-6 |

Deposit Accounts Composition |

II-6 |

|

|

|

II-7 |

Borrowed Funds Composition |

II-7 |

|

|

|

II-8 |

Office Properties |

II-8 |

|

|

|

III |

Financial and Market Data for All Public Thrifts |

III-1 |

|

|

|

IV-1 |

Pro Forma Assumptions for the Stock Offering |

IV-1 |

|

|

|

IV-2 |

Pro Forma Conversion Valuation Range |

IV-2 |

|

|

|

IV-3 |

Pro Forma Conversion Analysis at the Midpoint Value |

IV-3 |

|

|

|

IV-4 |

Comparative Valuation Ratio Analysis |

IV-4 |

|

|

|

|

|

|

|

i

Feldman Financial Advisors, Inc.

LIST OF TABLES

|

TAB |

|

|

PAGE |

|

|

|

|

|

|

|

|

I. |

Chapter One – Business of North Shore MHC |

|

||

|

|

Table 1 |

Selected Financial Condition Data |

10 |

|

|

|

Table 2 |

Relative Balance Sheet Concentrations |

11 |

|

|

|

Table 3 |

Income Statement Summary |

19 |

|

|

|

Table 4 |

Income Statement Ratios |

21 |

|

|

|

Table 5 |

Yield and Cost Summary |

23 |

|

|

|

Table 6 |

Net Portfolio Value of Equity |

25 |

|

|

|

Table 7 |

Net Interest Income Sensitivity |

27 |

|

|

|

Table 8 |

Non-performing Asset Summary |

29 |

|

|

|

Table 9 |

Allowance for Loan Losses |

30 |

|

|

|

Table 10 |

Selected Demographic Data |

35 |

|

|

|

Table 11 |

Total Employment Force by Industry Sectors |

37 |

|

|

|

Table 12 |

Branch Office Deposit Data |

38 |

|

|

|

Table 13 |

Deposit Market Share in Lake County, Illinois |

40 |

|

|

|

Table 14 |

Deposit Market Share in the Chicago MSA |

41 |

|

|

|

|

|

|

|

|

II. |

Chapter Two – Comparisons with Publicly Traded Companies |

|

||

|

|

Table 15 |

Comparative Group Operating Summary |

49 |

|

|

|

Table 16 |

Key Financial Comparisons |

51 |

|

|

|

Table 17 |

General Operating Characteristics |

58 |

|

|

|

Table 18 |

Summary Financial Performance Ratios |

59 |

|

|

|

Table 19 |

Income and Expense Analysis |

60 |

|

|

|

Table 20 |

Balance Sheet Composition |

61 |

|

|

|

Table 21 |

Growth Rates, Credit Risk, and Loan Composition |

62 |

|

|

|

|

|

|

|

|

III. |

Chapter Three – Market Value Adjustments |

|

||

|

|

Table 22 |

Selected Demographic Data of Primary Market Areas |

67 |

|

|

|

Table 23 |

Summary of Illinois Bank and Thrift Acquisition Activity |

72 |

|

|

|

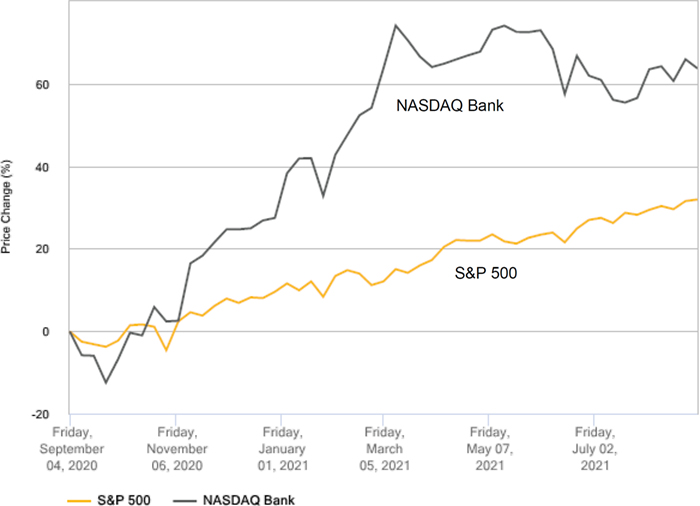

Table 24 |

Comparative One-Year Stock Index Performance |

76 |

|

|

|

Table 25 |

Comparative Three-Year Stock Index Performance |

77 |

|

|

|

Table 26 |

Summary of Standard Conversion Stock Offerings |

78 |

|

|

|

Table 27 |

Comparative Pro Forma Market Valuation Analysis |

85 |

|

ii

Feldman Financial Advisors, Inc.

INTRODUCTION

At your request, we have completed and hereby provide an independent appraisal (the “Appraisal”) of the estimated pro forma market value of North Shore MHC (the “Company”) as of August 31, 2021 in conjunction with the Company’s conversion (the “Conversion”) from the mutual holding company to stock form of organization, issuance of all of its capital stock to a newly formed stock holding company known as NSTS Bancorp, Inc. (“NSTS Bancorp”), and offering for sale of NSTS Bancorp’s common stock to eligible depositors and borrowers of North Shore Trust and Savings (the “Bank”), the Bank’s employee stock ownership plan, and certain members of the general public in the subscription and community offering (the “Stock Offering”). The Conversion is being undertaken pursuant to a Plan of Conversion adopted by the Boards of Directors of the Company, the Bank, and the mid-tier stock holding company, NSTS Financial Corporation (“NSTS Financial”). The Appraisal is furnished pursuant to the filing by the Company of applications with respect to the Conversion and the Stock Offering with the Board of Governors of the Federal Reserve System (“FRB”) and the Office of the Comptroller of the Currency (“OCC”).

Feldman Financial Advisors, Inc. (“Feldman Financial”) is a financial consulting and advisory firm that specializes in valuations and analyses of business enterprises and securities in the thrift, banking, and mortgage industries. The background of Feldman Financial is presented in Exhibit I. In preparing the Appraisal, we conducted an analysis of the Company that included discussions with the Company’s management, the Company’s legal counsel, Vedder Price P.C., and the Company’s independent registered public accounting firm, Plante Moran, PLLC. In addition, where appropriate, we considered information based on other available published sources that we believe are reliable; however, we cannot guarantee the accuracy and completeness of such information. We also reviewed, among other factors, the economy in the Company’s primary market area and compared the Company’s financial condition and operating performance with that of selected publicly traded thrift institutions. We reviewed conditions in the securities markets in general and in the market for thrift institution common stocks in particular.

1

Feldman Financial Advisors, Inc.

The Appraisal is based on the Company’s representation that the information in the Conversion applications and additional evidence furnished to us by the Company and its independent auditor are truthful, accurate, and complete. We did not independently verify the financial statements and other information provided by the Company and its independent accounting firm, nor did we independently value the assets or liabilities of the Company. The Appraisal considers the Company only as a going concern and should not be considered as an indication of the liquidation value of the Company.

Our Appraisal is not intended, and must not be construed, to be a recommendation of any kind as to the advisability of purchasing shares of common stock in the Stock Offering. Moreover, because the Appraisal is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of stock in the Stock Offering will thereafter be able to sell such shares at prices related to the foregoing estimate of the Company’s pro forma market value. Feldman Financial is not a seller of securities within the meaning of any federal or state securities laws, and any report prepared by Feldman Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities.

The Valuation Range reported herein will be updated as appropriate. These updates will consider, among other factors, any developments or changes in the Company’s operating performance, financial condition, or management policies, and current conditions in the securities markets for thrift institution common stocks. Should any such new developments or changes be material, in our opinion, to the valuation of the Company, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in detail at that time.

2

Feldman Financial Advisors, Inc.

I. Business of North Shore Mhc

General Overview

North Shore MHC is a federally-chartered mutual holding company that functions as the parent company of NSTS Financial, a federally-chartered mid-tier stock holding company. NSTS is the parent company of the Bank, a federally-chartered stock savings institution. The Bank was established originally in 1921 as North Shore Building and Loan, an Illinois-chartered institution. In 2005, the Bank converted to a federally-chartered savings institution and reorganized into the mutual holding company form of organization. Since its inception, the Bank has operated as a traditional savings institution focused primarily on serving the banking needs of customers in its market area of Lake County, Illinois, and adjacent communities.

The Company operates from its headquarters and main banking office in Waukegan, Illinois, along with two additional full-service branch offices located in Waukegan and Lindenhurst, Illinois, respectively. The Company also has a loan production office in Chicago, Illinois. The Company’s business consists primarily of taking deposits from the general public and investing those deposits, together with funds generated from operations, in one- to four-family residential mortgage loans and purchase investments. The Company also invests in securities, historically consisting primarily of residential mortgage-backed securities issued by U.S. Government-sponsored enterprises, collateralized mortgage obligations, municipal obligations, and U.S. Government agency obligations. The Company offers a variety of deposit accounts, including checking accounts, savings accounts, money market accounts, and certificates of deposit.

At June 30, 2021, the Company had consolidated total assets of $239.9 million, total deposits of $184.4 million, and total equity of $45.9 million (measuring 19.13% of total assets). The Company reported a net loss of -$112,000 for the year ended December 31, 2020 and net income of $414,000 for the year ended December 31, 2019. The Bank’s deposits are insured up to applicable limits by the Federal Deposit Insurance Corporation (“FDIC”). The Bank is subject to regulation, examination, and supervision primarily by the OCC and secondarily by the FDIC. The Bank is also a member of the Federal Home Loan Bank (“FHLB”) of Chicago. The Company is subject to regulation by the FRB.

3

Feldman Financial Advisors, Inc.

Over the past ten years, the Bank has emphasized conservative lending, controlled growth, and an emphasis on managing liquidity and interest rate risk. The Bank’s total assets decreased by 7.7% from $262.5 million at December 31, 2010 to $242.2 million at December 31, 2020. The Bank’s total loans decreased by 30.8% from $146.3 million at December 31, 2010 to $101.3 million at December 31, 2020. The Bank’s ratio of total loans to total deposits decreased from 67.6% at year-end 2010 to 53.3% at year-end 2020. Over this same time period, the Bank’s ratio of total equity to total assets increased from 16.16% at year-end 2010 to 18.85% at year-end 2020.

The Bank’s 100-year operating history has provided it with a familiarity of its local communities and customer base. The Bank believes that its community orientation is attractive to customers and distinguishes it from the larger banks that operate in the local market area. The Bank continues to stress high quality, personal customer service through an honest, straightforward, and upfront marketing approach and has developed a loyal customer base. The Bank relies on its experienced and committed staff to meet the needs of customers. The Bank has a diverse staff, many of whom are bilingual, to assist with effectively serving the expanding Hispanic population in Waukegan. The Bank relies on its upgraded technology infrastructure to provide efficient and effective delivery of products and services. In recent years, the local market has experienced a significant amount of consolidation among its banking institutions, resulting in opportunities to pursue customer relationships that may have been disrupted as a result of mergers and acquisitions. The Lindenhurst branch office was opened to service an increasing population in the western part of Lake County. The Bank established a loan production office in the Roscoe Village neighborhood of Chicago, Illinois in 2016 to originate loans outside of its branch network in a more densely populated metropolitan area.

4

Feldman Financial Advisors, Inc.

The Company’s current operating goal is to position the organization to succeed in an evolving and competitive financial services landscape and enhance its position as one of the leading community banking institutions in its market. The Company believes that it can provide long-term value to its stockholders, customers, employees, and the communities it serves by executing a prudent business strategy that generates increasing profitability. The Company also believes there is a significant opportunity for a community-focused banking institution to compete effectively in its primary market area and that the increased capital it will have after the completion of the Stock Offering will facilitate this objective. The Company has emphasized and invested in a strong workforce, upgraded technology, and enhanced brand awareness in its market area. The core elements of the Company’s business strategy are outlined in more detail below:

| ● | Moderately grow the loan portfolio while continuing the sale of one-to four-family residential mortgages in the secondary market. The Company’s primary lending focus has been the origination of one- to four-family residential mortgage loans. As of June 30, 2021, $87.9 million or 89.7% of the Company’s loan portfolio was secured by one- to four-family residential mortgage loans. The Company believes that prudently increasing its one-to four -family, multi-family, and commercial real estate lending offers an opportunity to enhance its profitability and growth prospects. The Company plans to continue selling a portion of its loan production into the secondary market as a means to generate non-interest income, as well as manage interest rate and credit risk as long as market conditions are favorable to do so. |

| ● | Leverage technology to enhance customer experience and drive operating efficiencies. Over the past several years, the Company expanded its digital platform to include web-based and mobile application-based online banking. The Company aims to make upgrades continually to its online and mobile banking suites. Management has emphasized streamlining of internal processes and seeks to increase operating efficiencies through automation whenever possible. The Company plans to continue to invest in convenience technologies and employee training to enhance customer experience and keep pace with consumer demands. |

5

Feldman Financial Advisors, Inc.

| ● | Increase loan production through the formation of loan production offices. The Company originates loans through its three full-service branch locations in Waukegan and Lindenhurst, Illinois, and one loan production office in Chicago. The Company is currently reviewing sites to add up to three additional loan production offices in its surrounding communities over the next few years. |

| ● | Continue to emphasize prudent credit risk management. The Company is pursuing moderate portfolio growth because it believes strong asset quality is a key to its long-term financial success. The Company’s strategy for credit risk management focuses on having an experienced team of credit professionals, well-defined policies and procedures, appropriate loan underwriting criteria, and active credit monitoring. The Company’s ratio of non-performing assets to total assets ratio was 0.24% at June 30, 2021, 0.15% at December 31, 2020, and 0.03% at December 31, 2019. Because substantially all of the Company’s loans are secured by real estate and the level of its non-performing loans has been low in recent years, the Company believes that its current allowance for loan losses is adequate to account for the probable losses inherent in its loan portfolio. |

| ● | Grow the franchise organically. The Company expects to embark on a strategy of prudent growth following the Conversion and Stock Offering. The Company seeks to expand its market share in existing and contiguous markets by leveraging its longstanding ties to the community and delivering high-quality financial solutions. Building customer relationships around low-cost and no-cost products is part of the Company’s relationship expansion strategy. These accounts can be established with a modest initial deposit, impose minimal fees, and are a viable alternative for the consumer to non-bank money service businesses. |

| ● | Recruit and retain top talent. Recruiting and retaining talented individuals to implement the Company’s business strategy will be critical to its success. While the Company believes it has assembled a strong management team, it plans to continue assessing its personnel needs and expects to add new lenders and management staff in order to facilitate planned growth and to complement the existing management team. Critical to the Company’s efforts to attract and retain talent are the Conversion and the adoption and implementation of employee stock benefit plans, consistent with federal banking regulations and subject to shareholder approval, after the Conversion. |

6

Feldman Financial Advisors, Inc.

While its equity level is solid at 19.13% of total assets as of June 30, 2021, the Company believes it must raise additional capital in order to facilitate its growth objectives and loangeneration activity, and provide a greater cushion in response to the risk profile associated with continued expansion and future economic conditions. As a stock organization upon completion of the Conversion, the Company will be organized in the ownership form used by commercial banks, most major businesses, and a large number of thrift institutions. The ability to raise new equity capital through the issuance and sale of capital stock will allow the Company the flexibility to increase its equity capital position more rapidly than by accumulating earnings.

The Company also believes that the ability to attract new capital also will help address the needs of the communities it serves and enhance its ability to expand or to make acquisitions. After the Conversion, the Company will have an increased ability to merge with or acquire other financial institutions or business enterprises; however, there are no current arrangements, understandings, or agreements regarding any such acquisition opportunities. Finally, the Company expects to benefit from its employees and directors having stock ownership in its business, since that is viewed as an effective performance incentive and a means of attracting, retaining, and compensating employees and directors.

In summary, the Company’s primary reasons for implementing the Conversion and undertaking the Stock Offering are to:

| ● | Enhance its capital base to support growth and compete more effectively in the financial services marketplace. |

| ● | Offer depositors, employees, management, and directors an equity ownership interest in NSTS Bancorp, the proposed publicly-traded holding company, and thereby an economic interest in the potential future success of NSTS Bancorp and the Bank. |

| ● | Attract and retain qualified directors, management, and employees by establishing various stock-based benefit plans. |

| ● | Increase the Company’s flexibility to structure and finance the expansion of its operations, including potential acquisitions of other financial service businesses and establishing new branches or new loan production offices. |

7

Feldman Financial Advisors, Inc.

The remainder of Chapter I examines in more detail the trends addressed in this section, including the impact of changes in the Company’s economic and competitive environment, and recent strategic initiatives. The discussion is supplemented by the exhibits in the Appendix. Exhibit II-1 summarizes the Company’s consolidated balance sheets as of December 31, 2019 and 2020 and June 30, 2021. Exhibit II-2 presents the Company’s consolidated income statements for the years ended December 31, 2019 and 2020 and the six months ended June 30, 2020 and 2021.

9

Feldman Financial Advisors, Inc.

Financial Condition

Table 1 presents selected data concerning the Company’s financial position as of December 31, 2019 and 2020 and June 30, 2021. Table 2 displays relative balance sheet concentrations as of similar period-end dates.

Table 1

Selected Financial Condition Data

As of December 31, 2019 and 2020 and June 30, 2021

(Dollars in Thousands)

|

|

|

June 30, |

|

December 31, |

||||||||||

|

|

|

2021 |

|

2020 |

|

2019 |

||||||||

|

Total assets |

|

$239,858 |

|

|

$242,219 |

|

|

$235,549 |

|

|||||

|

Cash and cash equivalents (1) |

|

26,549 |

|

|

44,304 |

|

|

52,550 |

|

|||||

|

Investment securities available for sale |

|

98,284 |

|

|

81,620 |

|

|

68,569 |

|

|||||

|

Federal Home Loan Bank stock |

|

550 |

|

|

512 |

|

|

512 |

|

|||||

|

Total loans, net (2) |

|

98,240 |

|

|

100,426 |

|

|

98,399 |

|

|||||

|

Premises and equipment, net |

|

5,146 |

|

|

5,213 |

|

|

5,400 |

|

|||||

|

Bank-owned life insurance |

|

8,978 |

|

|

8,890 |

|

|

8,707 |

|

|||||

|

Total deposits |

|

184,406 |

|

|

186,404 |

|

|

184,371 |

|

|||||

|

Federal Home Loan Bank advances |

|

5,000 |

|

|

4,000 |

|

|

- |

|

|||||

|

Total equity |

|

45,875 |

|

|

46,725 |

|

|

45,764 |

|

|||||

|

(1) |

Includes interest-bearing and time deposits with other financial institutions. |

|

(2) |

Includes loans held for sale. |

| Source: North Shore MHC, financial statements. |

Asset Composition

The Company’s total assets amounted to $239.9 million at June 30, 2021, reflecting a 1.0% or $2.3 million decrease from total assets of $242.2 million at December 31, 2020. In the prior year, the Company’s total assets increased by 2.8% or $6.7 million from $235.5 million at December 31, 2019 to $242.2 million at December 31, 2020. The recent contraction of total assets was primarily attributable to a moderate decrease of $2.2 million in total net loans from $100.4 million at December 31, 2020 to $98.2 million at June 30, 2021.

9

Feldman Financial Advisors, Inc.

Table 2

Relative Balance Sheet Concentrations

As of December 31, 2019 and 2020 and June 30, 2021

(Percent of Total Assets)

| June 30, | December 31, | |||||||||||||

| 2021 | 2020 | 2019 | ||||||||||||

| Cash and cash equivalents (1) | 11.07 | % | 18.29 | % | 22.31 | % | ||||||||

| Investment securities available for sale | 40.98 | 33.70 | 29.11 | |||||||||||

| Federal Home Loan Bank stock | 0.23 | 0.21 | 0.22 | |||||||||||

| Total loans, net (2) | 40.96 | 41.46 | 41.77 | |||||||||||

| Premises and equipment, net | 2.15 | 2.15 | 2.29 | |||||||||||

| Bank-owned life insurance | 3.74 | 3.67 | 3.70 | |||||||||||

| Other assets | 0.88 | 0.52 | 0.60 | |||||||||||

| Total assets | 100.00 | % | 100.00 | % | 100.00 | % | ||||||||

| Total deposits | 76.88 | % | 76.96 | % | 78.27 | % | ||||||||

| Federal Home Loan Bank advances | 2.08 | 1.65 | - | |||||||||||

| Other liabilities | 1.91 | 2.10 | 2.30 | |||||||||||

| Total liabilities | 80.87 | 80.71 | 80.57 | |||||||||||

| Total equity | 19.13 | 19.29 | 19.43 | |||||||||||

| Total liabilities and equity | 100.00 | % | 100.00 | % | 100.00 | % | ||||||||

|

(1) |

Includes interest-bearing and time deposits with other financial institutions. |

|

(2) |

Includes loans held for sale. |

| Source: North Shore MHC, financial statements. |

Total net loans (including loans held for sale) decreased during the first half of 2021 as total loan sales and principal repayments exceeded total loan originations. Consistent with its interest rate risk strategy, the Company has continued to sell, on a servicing released basis, a portion of its fixed-rate, one- to four-family residential mortgage originations. As a result of the recent decrease in the Company’s loan portfolio, the percentage of total net loans decreased from 41.8% of total assets at December 31, 2019 to 41.0% of total assets at June 30, 2021.

10

Feldman Financial Advisors, Inc.

Cash and cash equivalents have decreased by $26.0 million from $52.6 million at December 31, 2019 to $26.6 million at June 30, 2021. The decrease in cash and cash equivalentsprimarily reflected outgoing cash flows to purchase increased amounts of investment securities available for sale, which increased by $29.7 million from $68.6 million at December 31, 2019 to $98.3 million at June 30, 2021. The increased level of securities was related to the Company’s objectives to manage interest rate risk and increase yields on earning assets. As a result of the reallocation of liquidity, aggregate cash and cash equivalents decreased from 22.3% of total assets at December 31, 2019 to 11.1% at June 30, 2021. Concurrently, investment securities increased from 29.1% of assets at December 31, 2019 to 41.0% of total assets at June 30, 2021.

The balance sheet value of bank-owned life insurance (“BOLI”) increased moderately from $8.7 million at December 31, 2019 to $9.0 million at June 30, 2021. BOLI provides the Company with a funding offset for employee benefit plans and obligations and also generates non-interest that generally is non-taxable. The percentage of BOLI to total assets measured 3.7% of total assets at June 30, 2021.

The largest segment of the Company’s loan portfolio comprises residential estate mortgage loans. As of June 30, 2021, one- to four-family residential mortgage loans accounted for 89.7% of total loans as illustrated in Exhibit II-3. The Company’s loan portfolio also included smaller concentrations of multi-family real estate loans (5.3% of total loans), commercial real estate loans (4.7% of total loans), and consumer loans (0.3% of total loans) at June 30, 2021.

Exhibit II-4 details the Company’s recent lending activity. For the six months ended June 30, 2021, the Company originated $23.8 million of loans, including $22.7 million of one- to four-family residential mortgage loans and $1.0 million of commercial real estate loans. For the year ended December 31, 2020, the Company originated $56.5 million of loans, including $52.7 million of one- to four-family residential mortgage loans and $3.5 million of commercial real estate loans. The Company’s loan sales amounted to $35.3 million for the year ended December 31, 2020 and $13.3 million for the six months ended June 30, 2021. The Company considers its balance sheet and interest rate risk management objectives along with prevailing market conditions in making decisions as whether to hold or sell originated residential mortgage loans.

11

Feldman Financial Advisors, Inc.

At June 30, 2021, the Company had $87.9 million in one- to four-family residential mortgage loans, which represented 89.7% of total loans. Of the one- to four-family mortgage loans due after June 30, 2022, approximately $72.8 million or 84.4% consisted of fixed-rate loans and $13.4 million or 15.6% consisted of adjustable-rate loans. A small portion of the Company’s one- to four-family residential mortgage loans are considered non-conforming due to factors such as the borrower’s job status or income, the condition or age of the residence or other factors and are not readily saleable into the secondary mortgage market. The Company generally limits the loan-to-value ratios of its residential mortgage loans to 97% for adjustable-rate loans and 95% for fixed-rate loans, provided that the borrower obtains private mortgage insurance on loans that exceed 80% of the appraised value of the secured property. The Company’s fixed-rate residential mortgage loans are fully amortizing with maturities of up to 30 years, while the adjustable-rate loans have interest rates that either adjust on an annual basis or are fixed for the initial three or five years and then adjust every three or five years thereafter. At June 30, 2021, the average one- to four-family residential mortgage loan size was approximately $147,000.

At June 30, 2021, the Company had $9.8 million in commercial real estate and multi-family real estate loans, which represented 10.0% of total loans. Of this aggregate total, the Company’s commercial real estate loans amounted to $4.6 million and multi-family residential loans amounted to $5.2 million as of June 30, 2021. The Company’s commercial and multi-family real estate lending activity is consistent with its strategy to diversify the loan portfolio and increase the overall portfolio yield with shorter-maturity loans. The commercial real estate loans include 14 loans that are secured primarily by investor properties, which include one- to four-family residences. Additionally, the company has two commercial real estate loans secured by retail frontage. The two largest commercial real loans outstanding at June 30, 2021 were $2.0 million and $1.4 million, both of which were paying in accordance with all their contractual terms. The Company’s multi-family residential mortgage loans are secured by residential properties with more than four units or secured by multiple one- to four-family residential properties. The Company’s largest multi-family loan as of June 30, 2021 was a $940,000 loan secured by various one- to four-family investment homes and one multi-family apartment building located in Waukegan and North Chicago, Illinois, and was performing in accordance with its terms. At June 30, 2021, the average sizes of the Company’s multi-family residential mortgage loans and commercial real estate loans were approximately $347,000 and $169,000, respectively.

12

Feldman Financial Advisors, Inc.

The Company’s consumer loans amounted to $303,000 or 0.3% of the total loan portfolio as of June 30, 2021. The Company offers a limited range of consumer loans, principally to provide a full range of financial products to its customers. The Company’s outstanding consumer loans primarily comprised loans secured by deposits, automobile loans, and unsecured personal loans. During the six months ended June 30, 2021, the Company charged off a $99,000 unsecured consumer loan because it was six months past due but is continuing its collection efforts. There were no consumer loan charge-offs during the years ended December 31, 2019 and 2020.

Exhibit II-5 presents a summary of the Company’s portfolio of cash, short-term liquidity, and investment securities as of December 31, 2019 and 2020 and June 30, 2021. The Company’s primary investment objectives include the following: (1) manage the interest rate sensitivity of the balance sheet; (2) generate a favorable return without incurring undue interest rate and credit risk; (3) complement and supplement lending activities; and (4) provide and maintain liquidity to meet deposit withdrawal and loan funding needs. The Company’s investment strategies and policies are established by the Board of Directors.

13

Feldman Financial Advisors, Inc.

At June 30, 2021, the Company’s aggregate cash and investments amounted to $125.4 million or 52.3% of total assets. Cash and cash equivalents (including interest-bearing deposits and certificates of deposit with other financial institutions) amounted to $26.5 million or 11.1% of the Company’s total assets as of June 30, 2021. Cash and cash equivalents decreased from $52.6 million or 22.3% of total assets as of December 31, 2019 as excess liquidity has been reallocated into investment securities. The Company’s available-for-sale securities portfolio totaled $98.3 million or 41.0% of total assets at June 30, 2021 and was composed of $49.7 million of mortgage-backed securities, $29.0 million of collateralized mortgage obligations, $11.1 million of municipal obligations, and $8.4 million of U.S. Government and agency obligations. The Company’s mortgage-backed securities and obligations are issued by U.S. Government-sponsored enterprises. The Company’s available-for-sale investment securities portfolio had a weighted average yield of 1.66% at June 30, 2021. The Company also owned $550,000 of stock in the FHLB of Chicago as of June 30, 2021.

Liability Composition

Deposits are the Company’s primary external source of funds for lending and investment purposes. Exhibit II-6 presents a summary of the Company’s deposit composition as of December 31, 2019 and 2020 and June 30, 2021. Total deposits amounted to $184.4 million or 76.9% of total assets and 95.1% of total liabilities at June 30, 2021. Total deposits decreased by 1.1% or $2.0 million from $186.4 million at December 31, 2020 to $184.4 million at June 30, 2021. The Company’s certificate accounts decreased by $4.1 million in the first half of 2021, while core transaction accounts increased by $2.1 million. The ratio of core transaction accounts to total deposits has increased from 61.0% at December 31, 2019 to 65.4% at June 30, 2021, while the concentration of certificate accounts decreased from 39.0% to 34.6% over the same time period.

14

Feldman Financial Advisors, Inc.

The Company relies on customer service and longstanding relationships with customers in its primary market area to attract and retain deposits. Deposit account terms vary according to the minimum balance required, the time period that funds must remain on deposit, and the interest rate, among other factors. In determining the rates and terms of its deposit accounts, the Company considers the rates offered by competitors, liquidity needs, growth objectives, current operating strategies, and customer preferences and concerns. The Company has placed a concerted emphasis on attracting core transaction deposit accounts, which tend to represent lower cost and more stable funding sources. For the six months ended June 30, 2021, the Company’s weighted average cost of core deposits was 0.13%, the weighted average cost of certificate accounts was 1.24%, and the overall weighted average cost of deposits was 0.50%, reflecting a decline from the corresponding overall costs of 0.94% and 0.77% for the years ended December 31, 2019 and 2020, respectively.

As a member of the FHLB of Chicago, the Company may obtain FHLB borrowings based upon the security of FHLB capital stock owned and certain of the Company’s real estate mortgage loans. Historically, the Company has not utilized FHLB borrowings as a source of funds. However, the Company obtained a $4.0 million, zero-rate FHLB advance in May 2020 that subsequently matured in May 2021. The Company replaced the matured borrowing with a $5.0 million, zero-rate FHLB advance that matures in May 2022.

Equity Capital

The Company has historically maintained strong capital levels. The Company’s total equity amounted to $45.8 million or 19.13% of total assets at June 30, 2021. The ratio of total equity to assets decreased from 19.43% at December 31, 2019 and 19.29%at December 31, 2020 as the rate of moderate asset expansion outpaced the rate of capital formation due to the Company’s net operating losses in 2020 and the first half of 2021. The Company’s total equity increased by $961,000 from $45.8 million at year-end 2019 to $46.7 million at year-end largely due to an increase of $1.1 million in the Company’s accumulated other comprehensive income (“AOCI”). The Company’s AOCI is affected mainly by unrealized gains (or losses) on available-for-sale securities. The Company’s total equity decreased by $851,000 from $46.7 million at December 31, 2020 to $45.9 million at June 30, 2021 due to a decrease of $836,000 in AOCI related a decrease in the level of unrealized gains on available-for-sale securities.

15

Feldman Financial Advisors, Inc.

The Bank’s capital level remains strong in comparison to minimum regulatory requirements. The Bank’s equity capital amounted to $44.8 million or 18.69% of total assets at December 31, 2020. The Bank has opted into the Community Bank Leverage Ratio (“CBLR”) framework, which simplifies the financial reporting requirements for regulatory capital compliance for qualifying institutions. As of June 30, 2021, the Bank’s CBLR (equal to the tier 1 leverage capital ratio) was 18.45% which exceeded the regulatory capital requirement, and the Bank was considered to be well capitalized. To be considered well capitalized using the CBLR framework at June 30, 2021 required a ratio of 8.50% or higher.

While not applicable due to the Bank’s election of the CBLR framework, the Bank’s regulatory capital ratios of tier 1 leverage capital, common equity tier 1 risk-based capital, tier 1 risk-based capital, and total risk-based capital measured 18.45%, 51.60%, 51.60%, and 52.51%, respectively, as of June 30, 2021. In comparison, the minimum regulatory requirements under federal banking agency guidelines were 4.00%, 4.50%, 6.00%, and 8.00%, and the threshold requirements for regulatory well capitalized levels were 5.00%, 6.50%, 8.00%, and 10.00%, respectively, under prompt correction action provisions.

16

Feldman Financial Advisors, Inc.

Income and Expense Trends

Table 3 displays the main components of the Company’s earnings performance for the years ended December 31, 2019 and 2020 and the six months ended June 30, 2020 and 2021. Table 4 displays the Company’s principal income and expense ratios as a percent of average assets for the corresponding periods. Table 5 displays the Company’s weighted average yields on interest-earning assets and weighted average costs of interest-bearing liabilities.

General Overview

Over recent years, the Company has exhibited a recurring trend of low or negative earnings. The Company’s net income amounted to $414,000 for the year ended December 31, 2019 but declined to a net loss of -$112,000 for the year ended December 31, 2020 and a net loss of -$14,000 for the six months ended June 30, 2021. The Company reported a return on average assets (“ROA”) of 0.18% and -0.05% for 2019 and 2020, respectively, and -0.01% annualized for the six months ended June 30, 2021. The Company reported a return on average equity (“ROE”) of 0.92% and -0.24% for 2019 and 2020, respectively, and -0.06% annualized for the first half of 2021.

Compared to its asset size peer group of FDIC-insured savings institutions, the Company’s ROA of 0.18% in 2019 lagged the peer group average of 0.56% and its ROA of -0.05% in 2020 trailed the peer group average of 0.53%. Similarly, the Company’s annualized ROA of -0.01% for the first half of 2020 was below the peer group average of 0.58%. Compared to its regulatory peer group on a historical basis, the Company’s profitability trends are characterized by below-average levels of net interest income and non-interest income ratios, offset partially by lower non-interest expense ratios. The Company’s net interest margin of 1.86% for the first half of 2021 measured below the peer group average of 2.86% primarily due to the Company’s lower level of total net loans to assets, which measured 41.0% versus the peer group average of 61.4%.

17

Feldman Financial Advisors, Inc.

Table 3

Income Statement Summary

For the Years Ended December 31, 2019 and 2020

And the Six Months Ended June 30, 2020 and 2021

(Dollars in Thousands)

|

|

|

Six Months Ended |

|

Year Ended |

||||||||||||||||||

|

|

|

2021 |

2020 |

|

2020 |

|

2019 |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Interest income |

|

$ |

2,565 |

|

|

$ |

3,272 |

|

|

$ |

6,011 |

|

|

$ |

7,012 |

|

||||||

|

Interest expense |

|

|

490 |

|

|

|

840 |

|

|

|

1,488 |

|

|

|

1,726 |

|

||||||

|

Net interest income |

|

|

2,075 |

|

|

|

2,432 |

|

|

|

4,523 |

|

|

|

5,286 |

|

||||||

|

Provision for loan losses |

|

|

17 |

|

|

|

220 |

|

|

|

464 |

|

|

|

97 |

|

||||||

|

Net interest income after provision |

|

|

2,058 |

|

|

|

2,212 |

|

|

|

4,059 |

|

|

|

5,189 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Service charges on deposit accounts |

|

|

141 |

|

|

|

127 |

|

|

|

255 |

|

|

|

241 |

|

||||||

|

Gain on sale of mortgage loans |

|

|

245 |

|

|

|

146 |

|

|

|

787 |

|

|

|

285 |

|

||||||

|

Gain on sale of securities |

|

|

- |

|

|

|

59 |

|

|

|

59 |

|

|

|

- |

|

||||||

|

Gain on sale of other real estate owned |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

38 |

|

||||||

|

BOLI income |

|

|

88 |

|

|

|

90 |

|

|

|

182 |

|

|

|

188 |

|

||||||

|

Other income |

|

|

130 |

|

|

|

88 |

|

|

|

319 |

|

|

|

115 |

|

||||||

|

Total non-interest income |

|

|

604 |

|

|

|

510 |

|

|

|

1,603 |

|

|

|

867 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Salaries and employee benefits |

|

|

1,691 |

|

|

|

1,799 |

|

|

|

3,691 |

|

|

|

3,514 |

|

||||||

|

Occupancy and equipment |

|

|

341 |

|

|

|

352 |

|

|

|

689 |

|

|

|

770 |

|

||||||

|

Data processing |

|

|

328 |

|

|

|

247 |

|

|

|

565 |

|

|

|

463 |

|

||||||

|

Foreclosure expenses |

|

|

8 |

|

|

|

3 |

|

|

|

12 |

|

|

|

38 |

|

||||||

|

Other expense |

|

|

545 |

|

|

|

628 |

|

|

|

1,320 |

|

|

|

943 |

|

||||||

|

Total non-interest expense |

|

|

2,913 |

|

|

|

3,028 |

|

|

|

6,277 |

|

|

|

5,728 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Income (loss) before income taxes |

|

|

(251 |

) |

|

|

(306 |

) |

|

|

(615 |

) |

|

|

328 |

|

||||||

|

Income tax benefit |

|

|

(237 |

) |

|

|

(82 |

) |

|

|

(503 |

) |

|

|

(86 |

) |

||||||

|

Net income (loss) |

|

$ |

(14 |

) |

|

$ |

(224 |

) |

|

$ |

(112 |

) |

|

$ |

414 |

|

||||||

| Source: North Shore MHC, financial statements. |

Years Ended December 31, 2019 and 2020

Net income declined from $414,000 in 2019 to a net loss of -$112,000 in 2020. The primary reasons for the net loss in 2020 compared to 2019 were a $763,000 decrease in net interest income, a $549,000 increase in non-interest expense, and a $367,000 increase in the provision for loan losses, offset partially by a $736,000 increase in non-interest income and a $417,000 increase in the income tax benefit. The decline in net interest income was largely attributable to a decline in the Company’s net interest spread from 2.29% in 2019 to 1.86% in 2020 and an accompanying decline in the net interest margin from 2.49% in 2019 to 2.02% in 2020. The decreases in the net interest rate spread and net interest margin were mainly the result of a continuing low interest rate environment that reduced the average yields on earning assets in an amount that exceeded the reduction in the cost of funds.

18

Feldman Financial Advisors, Inc.

The increase in the provision for loan losses in 2020 reflected a combination of factors. The Company’s non-performing loans increased from $65,000 at December 31, 2019 to $355,000 at December 31, 2020. The Company also took into consideration the loan growth during the year and the uncertainty surrounding the economic impact of the coronavirus pandemic. As a result of the increased provision, the Company’s allowance for loan losses increased from $389,000 or 0.40% of total portfolio loans at December 31, 2019 to $870,000 or 0.88% of total portfolio loans at December 31, 2020.

The Company’s non-interest income increased by $736,000 from $867,000 in 2019 to $1.6 million in 2020. As a result, the ratio of non-interest income to average assets increased from 0.38% in 2019 to 0.67% in 2020. The increase in non-interest income was primarily due to a $502,000 increase in gain on sale of mortgage loans. The Company’s loan sale volume increased from $16.9 million in 2019 to $36.5 million in 2020.

The Company’s non-interest expense increased by $549,000 from $5.7 million in 2019 to $6.3 million in 2020, reflecting an increase in the non-interest expense to average assets ratio from 2.50% in 2019 to 2.62% in 2020. The primary increase in non-interest expense was salaries and employee benefits increasing by 5.0% or $177,000 from $3.5 million in 2019 to $3.7 million in 2020. Additionally, the increase in non-interest expense was driven by increases in data processing costs and professional services.

19

Feldman Financial Advisors, Inc.

Table 4

Income Statement Ratios

For the Years Ended December 31, 2019 and 2020

And the Six Months Ended June 30, 2020 and 2021

(Percent of Average Assets)

|

|

|

Year Ended |

|

|

Year Ended |

|

||||||||||||

|

|

|

2021 |

|

|

2020 |

|

|

2020 |

|

|

2019 |

|

||||||

|

Interest income |

|

|

2.13 |

% |

|

|

2.74 |

% |

|

|

2.50 |

% |

|

|

3.06 |

% |

||

|

Interest expense |

|

|

0.41 |

|

|

|

0.70 |

|

|

|

0.62 |

|

|

|

0.74 |

|

||

|

Net interest income |

|

|

1.72 |

|

|

|

2.03 |

|

|

|

1.88 |

|

|

|

2.31 |

|

||

|

Provision for loan losses |

|

|

0.01 |

|

|

|

0.18 |

|

|

|

0.19 |

|

|

|

0.04 |

|

||

|

Net interest income after provision |

|

|

1.71 |

|

|

|

1.85 |

|

|

|

1.69 |

|

|

|

2.26 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Service charges on deposit accounts |

|

|

0.12 |

|

|

|

0.11 |

|

|

|

0.11 |

|

|

|

0.11 |

|

||

|

Gain on sale of mortgage loans |

|

|

0.20 |

|

|

|

0.12 |

|

|

|

0.33 |

|

|

|

0.12 |

|

||

|

Gain on sale of securities |

|

|

0.00 |

|

|

|

0.05 |

|

|

|

0.02 |

|

|

|

0.00 |

|

||

|

Gain on sale of other real estate owned |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.02 |

|

||

|

BOLI income |

|

|

0.07 |

|

|

|

0.08 |

|

|

|

0.08 |

|

|

|

0.08 |

|

||

|

Other income |

|

|

0.11 |

|

|

|

0.07 |

|

|

|

0.13 |

|

|

|

0.05 |

|

||

|

Total non-interest income |

|

|

0.50 |

|

|

|

0.43 |

|

|

|

0.67 |

|

|

|

0.38 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Salaries and employee benefits |

|

|

1.40 |

|

|

|

1.50 |

|

|

|

1.54 |

|

|

|

1.53 |

|

||

|

Occupancy and equipment |

|

|

0.28 |

|

|

|

0.29 |

|

|

|

0.29 |

|

|

|

0.34 |

|

||

|

Data processing |

|

|

0.27 |

|

|

|

0.21 |

|

|

|

0.24 |

|

|

|

0.20 |

|

||

|

Foreclosure expenses |

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.02 |

|

||

|

Other expense |

|

|

0.45 |

|

|

|

0.52 |

|

|

|

0.55 |

|

|

|

0.41 |

|

||

|

Total non-interest expense |

|

|

2.42 |

|

|

|

2.53 |

|

|

|

2.62 |

|

|

|

2.50 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Income (loss) before income taxes |

|

|

(0.21 |

) |

|

|

(0.26 |

) |

|

|

(0.26 |

) |

|

|

0.13 |

|

||

|

Income tax benefit |

|

|

(0.20 |

) |

|

|

(0.07 |

) |

|

|

(0.21 |

) |

|

|

(0.04 |

) |

||

|

Net income (loss) |

|

|

(0.01 |

) |

|

|

(0.19 |

) |

|

|

(0.05 |

) |

|

|

0.18 |

|

||

| Source: North Shore MHC, financial statements and internal data. |

Six Months Ended June 30, 2020 and 2021

The Company reported a net loss of -$14,000 for the first half of 2021, as compared to a net loss of -$224,000 for the first half of 2020. The decrease in the loss for the 2021 period was chiefly attributable to a $203,000 decrease in the provision for loan losses and a $155,000 increase in the income tax benefit, offset partially by a $357,000 decrease in net interest income.

20

Feldman Financial Advisors, Inc.

Net interest income decreased by 14.7% or $357,000 from $2.4 million for the six months ended June 30, 2020 to $2.1 million for the six months ended June 30, 2021. The Company’s net interest spread declined from 2.00% for the first half of 2020 to 1.75% for the first half of 2021, while the net interest margin declined from 2.18% to 1.86% over the corresponding period. The Company’s weighted average yield on interest-earning assets measured 2.30% for the six months ended June 30, 2021 and its weighted average cost of interest-bearing liabilities was 0.55%. Over the comparable periods, the yield on interest-earning assets declined by 64 basis points and the cost of interest -bearing liabilities declined by only 39 basis points.

Non-interest income increased by $94,000 or 18.4% from $510,000 in the first half of 2020 to $604,000 for the first half of 2021. The increase in non-interest income was largely due to a $99,000 increase in gain on sale of mortgage loans from $146,000 in the first half of 2020 to $245,000 in the first half of 2021. The annualized ratio of non-interest income to average assets increased from 0.43% for the six months ended June 30, 2020 to 0.50% for the six months ended June 30, 2021.

Non-interest expense decreased by $115,000 or 3.8% from $3.0 million in the first half of 2020 to $2.9 million in the first half of 2021. The decrease in non-interest expense mainly reflected a $108,000 or 6.0% decrease in salaries and employee benefits from $1.8 million in the first half of 2020 to $1.7 million in the first half of 2021. The number of full-time equivalent employees decreased to 35 at June 30, 2021 as compared to 39 at June 30, 2020. This decrease was offset partially by an increase of $81,000 in data processing costs, which was related to an increase in network management costs as a result of technology upgrades to promote new products, services, and technology. The annualized ratio of non-interest expense to average assets decreased from 2.53% for the first half of 2020 to 2.42% for the first half of 2021.

21

Feldman Financial Advisors, Inc.

Table 5

Yield and Cost Summary

For the Years Ended December 31, 2019 and 2020

And the Six Months Ended June 30, 2020 and 2021

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

Six Months |

|

|

Year Ended |

|

||||||||||||

|

|

|

June 30, |

|

|

December 31, |

|

||||||||||||

|

|

|

|

2021 |

(1) |

|

|

2020 |

(1) |

|

|

2020 |

|

|

|

2019 |

|

||

|

Weighted Average Yields |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Loans receivable |

|

|

3.68 |

% |

|

|

4.26 |

% |

|

|

4.05 |

% |

|

|

4.42 |

% |

||

|

Federal funds sold and int.-bearing deposits |

|

|

0.08 |

|

|

|

0.64 |

|

|

|

0.37 |

|

|

|

2.06 |

|

||

|

Time deposits with other financial institutions |

|

|

1.08 |

|

|

|

2.39 |

|

|

|

2.11 |

|

|

|

2.66 |

|

||

|

Securities available for sale |

|

|

1.54 |

|

|

|

2.36 |

|

|

|

2.03 |

|

|

|

2.32 |

|

||

|

Federal Home Loan Bank stock |

|

|

2.26 |

|

|

|

2.34 |

|

|

|

2.54 |

|

|

|

2..13 |

|

||

|

Total interest-earning assets |

|

|

2.30 |

|

|

|

2.94 |

|

|

|

2.69 |

|

|

|

3.30 |

|

||

|

Weighted Average Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Interest-bearing demand |

|

|

0.04 |

|

|

|

0.10 |

|

|

|

0.08 |

|

|

|

0.09 |

|

||

|

Money market accounts |

|

|

0.20 |

|

|

|

0.64 |

|

|

|

0.47 |

|

|

|

1.05 |

|

||

|

Savings accounts |

|

|

0.15 |

|

|

|

0.25 |

|

|

|

0.24 |

|

|

|

0.24 |

|

||

|

Certificates of deposit accounts |

|

|

1.24 |

|

|

|

1.71 |

|

|

|

1.62 |

|

|

|

1.55 |

|

||

|

Total interest-bearing deposits |

|

|

0.56 |

|

|

|

0.94 |

|

|

|

0.84 |

|

|

|

1.01 |

|

||

|

Federal Home Loan Bank borrowings |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

||

|

Total interest-bearing liabilities |

|

|

0.55 |

|

|

|

0.94 |

|

|

|

0.83 |

|

|

|

1.01 |

|

||

|

Net interest rate spread (2) |

|

|

1.75 |

|

|

|

2.00 |

|

|

|

1.86 |

|

|

|

2.29 |

|

||

|

Net interest margin (3) |

|

1.86 |

|

|

|

2.18 |

|

|

|

2.02 |

|

|

|

2.49 |

|

|||

|

(1) |

Annualized ratios for the period. |

|

(2) |

Weighted average yield on interest-earning assets less the weighted average cost of interest-bearing liabilities. |

|

(3) |

Net interest income divided by average total interest-earning assets. |

| Source: North Shore MHC, financial data. |

The Company recorded an income tax benefit of $237,000 in the six months ended June 30, 2021, which reduced the pre-tax loss of -$251,000 to a net loss of -$14,000. Similarly, the Company recognized an income tax benefit of $82,000 in the six months ended June 30, 2020, which reduced the pre-tax loss of -$305,000 to a net loss of -$224,000. Previously, the Company recognized an income tax benefit of $503,000 in the year-ended December 31, 2020, which reduced the pre-tax loss of -$615,000 for the year to a net loss of -$112,000.

22

Feldman Financial Advisors, Inc.

Interest Rate Risk Management

The Company seeks to reduce its earnings vulnerability and capital risk to changes in market interest rates by managing the mismatch between asset and liability maturities and interest rates. The Company’s Asset/Liability Committee (“ALCO”) focuses on ensuring a stable and steadily increasing flow of net interest income through managing the asset and liability mix of the balance sheet. The ALCO is expected to integrate the Company’s asset/liability management process into its operational decision making, including portfolio structure, investments, business planning, funding decisions, and pricing. The ALCO is responsible for evaluating the interest rate risk inherent in the Company’s assets and liabilities, for determining the level of risk that is appropriate given the Company’s business strategy, operating environment, capital, liquidity, and performance objectives, and for managing this risk consistent with the policy and guidelines approved by the Board of Directors.

The Company attempts to manage its interest rate risk to minimize the exposure of earnings and capital to changes in market interest rates. The Company has implemented various strategies to manage its interest rate risk. By enacting these strategies, the Company believes that it is better positioned to react to changes in market interest rates. These strategies include:

| ● | Originating loans with adjustable interest rates. |

| ● | Promoting core deposit products. |

| ● | Selling a portion of fixed-rate one-to four -family residential mortgage loans. |

| ● | Maintaining investments as available -for-sale securities. |

| ● | Maintaining a meaningful level of assets in short-term liquidity holdings. |

| ● | Maintaining a substantial capital position, so as to increase the ratio of interest-earning assets relative to interest-rate sensitivity funding sources. |

| ● | Adjusting the size of the balance sheet. |

| ● | Modifying loan and deposit pricing/terms to influence customer behavior. |

23

Feldman Financial Advisors, Inc.

The Company monitors its interest rate sensitivity management through the use of models which generate estimates of the change in its net portfolio value (“NPV”) of equity over a range of interest rate scenarios. NPV represents the market value of portfolio equity, which is different from book value, and is equal to the market value of assets minus the market value of liabilities (representing the difference between incoming and outgoing discounted cash flows of assets and liabilities) with adjustments made for off-balance sheet items. The NPV ratio, under any interest rate scenario, is defined as the NPV in that scenario divided by the market value of assets in the same scenario. Table 6 sets forth the Company’s NPV as of June 30, 2021 and reflects the changes to NPV as a result of immediate and sustained changes in interest rates as indicated.

Table 6

Net

Portfolio Value of Equity

As of June 30, 2021

(Dollars in Thousands)

| Basis Point Change in Interest Rates (1) |

Estimated NPV (2) ($000s) |

Amount Change from Base ($000s) |

Percent Change from Base |

NPV Ratio (3) |

Basis Point Change in NPV Ratio | |||||||||||||||

| + 300 b.p. | $ | 29,102 | $ | (18,007 | ) | (38.22 | )% | 13.56 | % | (599) b.p. | ||||||||||

| + 200 b.p. | 35,244 | (11,865 | ) | (25.19 | )% | 15.79 | % | (376)b.p. | ||||||||||||

| + 100 b.p. | 41,654 | (5,455 | ) | (11.58 | )% | 17.92 | % | (163) b.p. | ||||||||||||

| Base | 47,109 | -- | -- | 19.55 | % | -- | ||||||||||||||

| - 100 b.p. | 51,440 | 4,331 | 9.19 | % | 20.85 | % | 130 b.p. | |||||||||||||

| - 200 b.p. | 52,744 | 5,635 | 11.96 | % | 21.26 | % | 171 b.p. | |||||||||||||

| (1) | Assumes an instantaneous uniform change in interest rates at all maturities. |

| (2) | NPV is the discounted present value of expected cash flows from assets, liabilities, and off-balance sheet contracts. |

| (3) | NPV ratio represents NPV divided by the present value of assets, which is calculated as the discounted value of incoming cash flows on interest-earning assets. |

Source: North Shore MHC, financial data.

24

Feldman Financial Advisors, Inc.

The table above indicates that at June 30, 2021, in the event of an instantaneous parallel 100 basis point increase in interest rates, the Company would experience an 11.6% decrease in NPV. In the event of an instantaneous 100 basis point decrease in interest rates, the Company would experience a 9.2% increase in NPV. The NPV simulations give no effect to any steps that the Company might take to counter the impact of such interest rate movement.

In addition to modeling changes in NPV, the Company also analyzes potential changes to net interest income for a 12-month period under rising and falling interest rate scenarios. The Company estimates its net interest income for a 12-month period, and then calculates what net interest income would be for the same period under the assumptions that the U.S. Treasury yield curve increases or decreases instantly by up to 300 basis points or decreases instantly by up to 200 basis points, in 100 point increments, with changes in interest rates representing immediate and permanent, parallel shifts in the yield curve.